But the truth is that there is a whole world of alternative investments outside the traditional markets and structures. In fact, many of them may even be related to your hobby and you haven’t even stopped to think about it.

What is considered an alternative investment?

The first thing to understand is the concept of alternative investments. From a technical point of view, these are investments in alternative assets that are defined by:

- Being conducted outside the stock market, independently of the financial markets. Many of these assets are bought or sold in private rather than public markets.

- Having little correlation with the markets. In other words, they function and move in a different way to the stock market and the financial markets. Correlation measures the relationship between two stocks or the phenomena that can affect them. Therefore, two highly correlated assets will behave in a similar way when faced with the same stimulus. For example, a share in a pharmaceutical company and another in a bank will fall if there is bad news for the stock market. On the other hand, the value of real estate will not, because it does not correlate with the stock market.

- Lack of liquidity. It does not always have to work this way, but one of the characteristics of alternative assets is that they have less liquidity than those traded in public markets (the stock market).

Examples of alternative investments with your hobby in mind

Classic examples of alternative investments are real estate, hedge funds, and some structured products. Crowdfunding or crowdlending and cryptocurrencies (here you can see the risks of investing in cryptocurrencies) also fall into this category.

All of these options are fine, but they are not really considered to be hobbies or entertainment. In other words, very few people spend their free time browsing apartments to buy, looking at which startups to invest in, or analyzing the crypto and blockchain ecosystem.

This is where another type of alternative investment comes into play, which is much closer to home and also more common: collecting.

Just about everyone has collected something in their lives, but few have ever considered it as an investment when it can actually become one.

There are artworks and objects to which it is easy to attribute a certain value. This is the case with works of art in general, but also with watches, fountain pens or numismatic objects (coins). To a greater or lesser extent, those who buy and collect these objects as a hobby are aware of their value as an investment, and if not, it does not take them long to realize.

With works of art it is clear, as it is with coins. For other objects we can easily recognize that they are not all equal, that some brands are better than others and retain their value better, and that there are also limited collections that increase in value over time.

Moreover, in the case of coins, there is an additional component. This is because they are a way to invest in gold. In fact, the value of many coins lies precisely in the percentage of gold they contain, which adds to their numismatic value.

Another group of people who have a clear idea of how much their purchases are worth are automotive collectors. The reason for this is that some cars appreciate in value. Investment vehicles tend to be specific models, often classics, and not the kind you would use or buy on a day-to-day basis.

The cars and motorcycles worth investing in are usually vintage and classic (not just old). In short, people who invest in these vehicles do so because they like them and they usually know what they are doing.

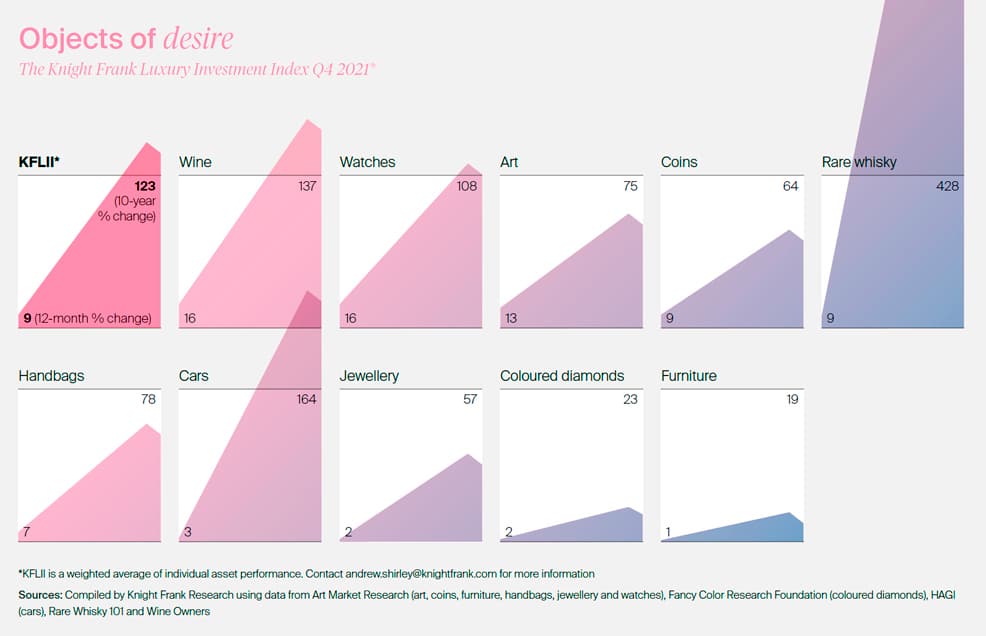

And from here we enter more or less unknown territory and not such traditional investments, like wine or spirits. In fact, according to the Wealth Report 2022 from the consulting firm Knight Frank, wine and contemporary art are the main luxury investment assets in Spain.

However, watches, cars and whiskey are the fastest growing alternative investments in the luxury sector. If any of these areas falls within the sphere of your hobby or leisure activities, you could dedicate part of your assets to investing in it.

There is more than one way to do it, as we will see below, although the most common is to buy, keep and then sell on specialist platforms or at auction houses, as the case may be.

This also applies to video games, sneakers, music, and even sports cards.

Fortunately, there is also life beyond luxury. In the United States, sports card collectibles are a classic and some can fetch hundreds of dollars.

Something similar is true of video games and certain limited edition games, or with music. Maybe the posters of your youth are not worth anything, but that Iron Maiden vinyl collection is, especially any limited editions.

Collecting means that you can collect anything and also invest in it. For example, a trend that also comes from the US, is the investment in sneakers.

The key at this point is knowing how to analyze the real market for your hobby, working out how many people are really interested in it, and whether it is something sustainable over time. Then, if it is something that might appeal to people with money to burn, so much the better.

How to invest in your hobby

The traditional way of investing in alternative assets of this type is buying and selling. Most of them are physical assets (NFTs aside) and collecting them implies having the original and keeping it. That is what happens with watches, fountain pens and works of art in general.

The procedure is simple:

- You buy the object you want, either new or on a specialist platform or second-hand sales page.

- You keep it as long as you deem appropriate.

- You sell it on a specialist platform.

Something that seems simple but implies that you understand how to operate and that you also know the best times for putting your assets back on the market.

What if there was another way to invest? For certain alternative investments there is another way, albeit with a slightly different approach.

For example, if you are passionate about video games, you can acquire old consoles as a collector and also invest in the sector through investment funds, ETFs or by buying shares in the video game companies you like the most.

Something similar happens with the spirits sector, where there are specialized ETFs (a type of investment fund that trades like a stock) in the sector and even for specific beverages such as beer or wine.

In the case of art you can invest in auction houses and also indexes and ETFs, or in specialized firms; and for lovers of classic cars, there are specialized companies dedicated to investing in these vehicles and which you can put your money into as a private individual.

The difference between buying yourself or investing through an intermediary is that the second option can be more liquid, since in many cases you are dealing with shares in companies and other listed vehicles.

In any event, before investing in your hobby, do your homework and research the industry so that your passion does not cloud your judgment.