The pension system in Spain

The origin of pensions in Spain dates back to the creation of the Social Reforms Commission in 1883, which was responsible for finding solutions to improve the quality of life of the working class.

Later, in 1900, the first social insurance was introduced through the Law on Accidents at Work and, in 1908, the Instituto Nacional de Previsión, the seed of the Social Security institute, was set up, which is the body that manages pensions in Spain. A lot has happened since then and the current pension system in Spain has little to do with those first steps.

How the pension system works in Spain

The public pension system in Spain is governed by five well-defined principles, which are as follows:

Distribution

The Spanish pension system is a pay-as-you-go system and not a capitalization system. The contributions of active workers finance the benefits of pensioners.

All active workers contribute to a single fund, the General Treasury of the Social Security, according to Article 21 of Law 8/2015 on Social Security. The money to pay retirees’ pensions is drawn from that fund. If the system were robust and sustainable, that income should be sufficient to cover total pension spending. Currently this is not the case.

Being a pay-as-you-go system, Spanish pensions are also based on the principle of financial or intergenerational solidarity, since one generation pays the state pensions of the next.

Contributory proportionality

The more you contribute, the more you get. That is basically what this principle consists of. It links the amount of a person’s pension to the amount they have paid in to the Social Security, which is what they have contributed to the system.

In practice this means that Social Security takes into account the amount contributed when calculating what a person’s state pension will be.

To access this contributory pension it is necessary to have paid into the system for a minimum number of years.

Universality

Pensions in Spain are universal, for everyone. That is why there are several types of Social Security pensions. On the one hand, there are contributory pensions, which are related to the amount paid in by the worker, and on the other hand, there are non-contributory pensions, which are those that give the system its universal character.

As their name indicates, these pensions do not depend on what each person has contributed. You can be eligible for one of these when you do not have the right to a contributory pension and they serve to cover the most basic needs of every retiree.

Logically, they are much less and more limited.

State management

Article 41 of the Spanish Constitution states that “The public authorities shall maintain a public social security system for all citizens, guaranteeing sufficient support and social benefits in situations of need, especially in the event of unemployment.”

This has been translated into a principle of state management according to which the management and financing of the pension system in Spain must be the responsibility of public bodies and, more specifically, of the Social Security.

Sufficiency of benefits

This is one of the most difficult principles to quantify. It establishes that the amount of the benefits must be sufficient to ensure basic needs.

This sufficiency of benefits is what is debated when talking about pension amounts or the need to update minimum pensions according to the CPI, regardless of the sustainability of the system itself.

How pensions are managed in Spain

These are the basic principles of the system, which are combined with those of the Social Security, which is the public agency that manages the pension money. The organization shares these values and adds those of:

Equity and equal rights, regardless of the time and place of residence (although there are eligibility requirements for state pensions).

Single fund, where the State is the sole holder of all the resources, obligations and benefits of the Social Security.

Financial solidarity between autonomous communities, as established in Article 74 of the Social Security Law. Added to the single fund, this means that some communities will pay the pensions of others.

Eligibility for state pensions

Pensions are universal, but in order to receive a contributory pension, a series of requirements must be met that have varied over the years.

Currently, for a retirement pension these requirements are:

You must have paid into the system for at least 15 years.

2 of those years must have been contributed in the 15 years immediately prior to your retirement date.

You must have reached the legal retirement age, which will increase to 67 by 2027 (or 65, as long as you have been contributing for more than 38.5 years). It is also possible to retire early, if certain conditions are met.

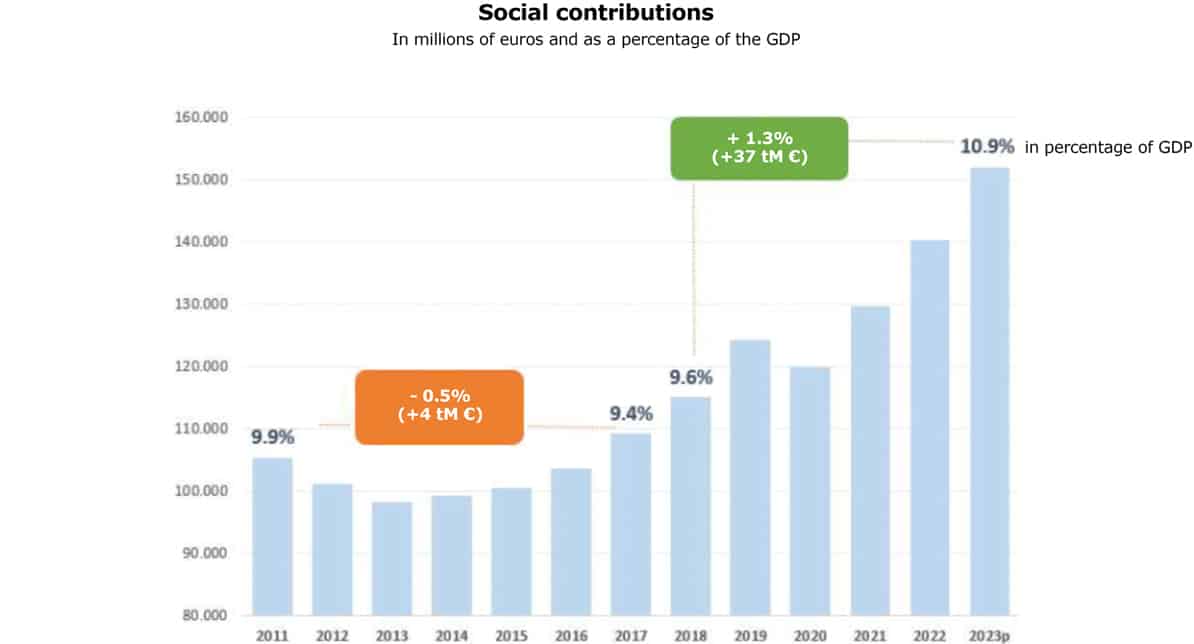

How pensions are financed in Spain

The way in which pensions are paid is explicitly set out in the principles of the national pension system: from the social contributions of active workers.

The specific amount depends on each worker’s salary, which in turn determines their contribution base. Every year Social Security establishes the maximum and minimum bases. On that basis, different types of contributions are applied. Those paid into the Social Security system are the contributions for common contingencies, which amount to 28.3%. Of that percentage, 23.6% is contributed by the company and the rest by the worker.

Since 2023 there has been an additional contribution of 0.6% (0.5% from the company and 0.1% from the worker), due to the Intergenerational Equity Mechanism (Mecanismo de Equidad Intergeneracional; MEI), which we will see below.

These inputs should be sufficient to pay out retirement pensions. However, this is not always the case. In fact, in recent years it has become commonplace for it not to be enough.

Who provides the pension money then? Who is in charge of the Social Security deficit? The deficit is assumed by the State to ensure that all retirees receive their pensions.

The Toledo pact and the evolution of pensions in Spain

The future of the Spanish pension system is a challenge, especially considering the aging of the population and increasingly tight salaries.

The Toledo Pact, a parliamentary commission created in 1995 to analyze the state of pensions and look for measures to improve them, was set up to find solutions. Many of the major changes in the system are the result of the Toledo Pact, although some have not been implemented, such as the 2013 pension revaluation index, which was due to come into force in 2023, but has been replaced by the MEI.

The MEI has not arisen from the Toledo Pact, and is instead an initiative from the Government. This is the last major change to try to balance the pension system equilibrium without having to freeze or reduce state pensions or increase the retirement age -although the latter is under discussion.

The Intergenerational Equity Mechanism is a contribution concept, in other words, an increase in social contributions which, however, does not generate a benefit. This contribution, which is purpose-oriented (it will not be permanent), will be extended until 2032 and is an additional effort required of workers to balance the accounts until 2032, when a new phase of pension system reform will begin, which is yet to be determined.