The sustainability of pension systems

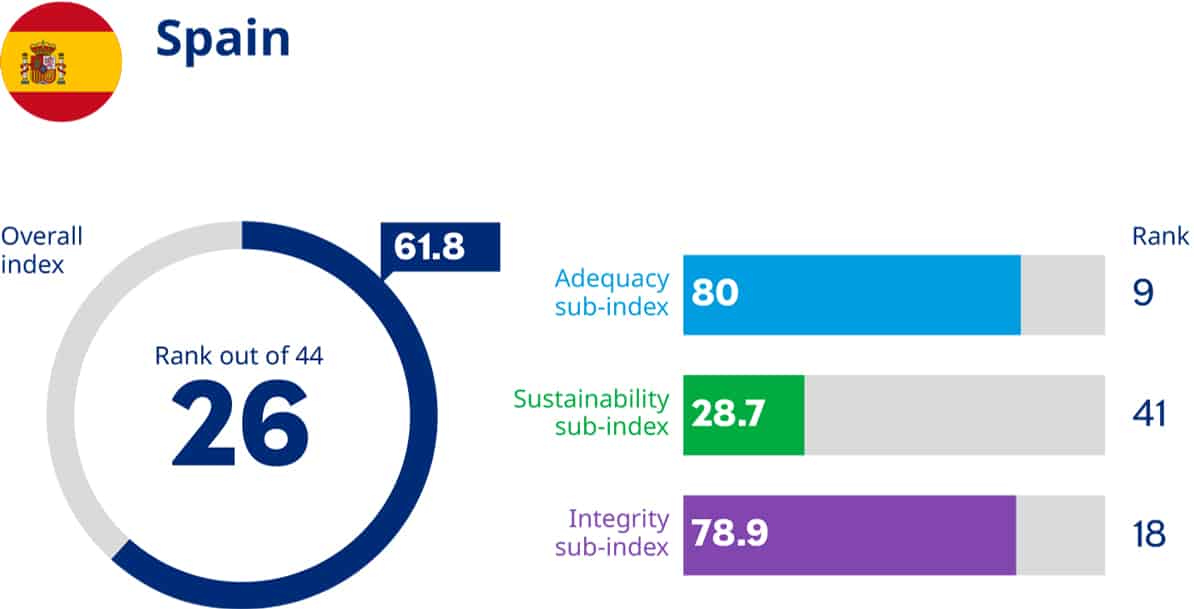

Among the three elements analyzed in the Global Pension Index report by Mercer and the CFA Institute to determine which pension systems are the best in the world, there is one that directly addresses the sustainability of the systems.

In other words, whether the system will be able to continue paying out the promised pensions or, on the contrary, its continuity is threatened. Among the factors analyzed are issues such as life expectancy, retirement age (legal and real), birth rate and the level of workers’ pension contributions. Also taken into account are elements such as the State’s debt in relation to its GDP, economic growth and whether it is possible to work and receive either a state or private pension at the same time.

The Spanish public pension system ranks number 41 in this section out of a total of 44 systems analyzed in the report.

Source: Mercer CFA Institute Global Pension Index 2022

Compared to Spain’s 28.7 points, the best systems in that section score more 80 points: Iceland (83.8), Denmark (82.5) and the Netherlands (81.9).

The Institute of Spanish Actuaries (IAE) analyzed the issue in 2019 and has continued to do so following the various changes made up to the present day. It considers that, even with the latest reforms, the sufficiency of pensions is not guaranteed 20 or 30 years down the road.

This simple fact already underscores the importance of considering whether the Spanish public pension system is really sustainable. These are the keys to understanding it:

A pay-as-you-go system, with its pros and cons.

The first thing we need to do to be able to answer the question of whether pensions in Spain are in trouble is to understand the Spanish pension model.

In short, state pensions operate under a pay-as-you-go model. In this system, the pensions of retirees are financed or paid for by the contributions of active workers. In other words, it is a system based on intergenerational solidarity (each generation pays the pensions of the preceding one and expects the next generation to do the same).

This model has advantages as well as drawbacks. One of the latter is its basic sustainability: For the system to work, the contributions of active workers must exceed pension spending.

In practical terms, this means that there have to be many more workers than pensioners, given that the former do not allocate 100% of their salaries to paying the pensions of their elders. In addition, other factors also play a role, such as the salaries of those in active employment and the amount of the retirees’ pensions.

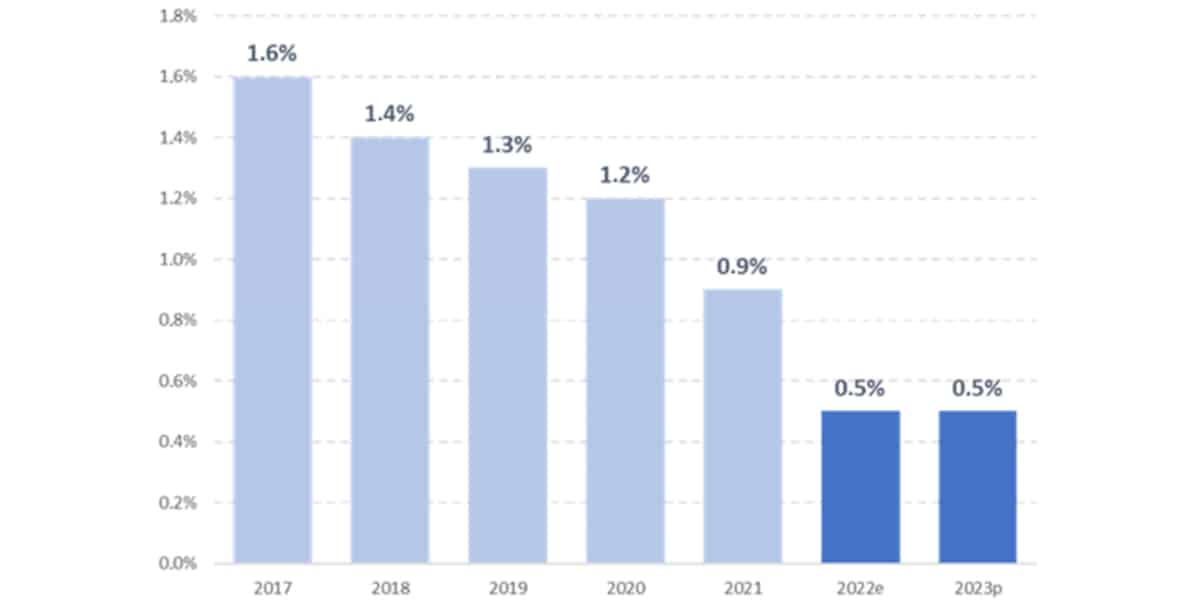

When this is not the case, the system incurs a deficit because it has more expenses than income. That is what has been happening for years. This is the evolution of that deficit:

Source: Revista La Seguridad Social

The year 2022 closed with 2.39 workers paying into the system for each pensioner, a high since 2011, although not all the data is positive. We will explain why.

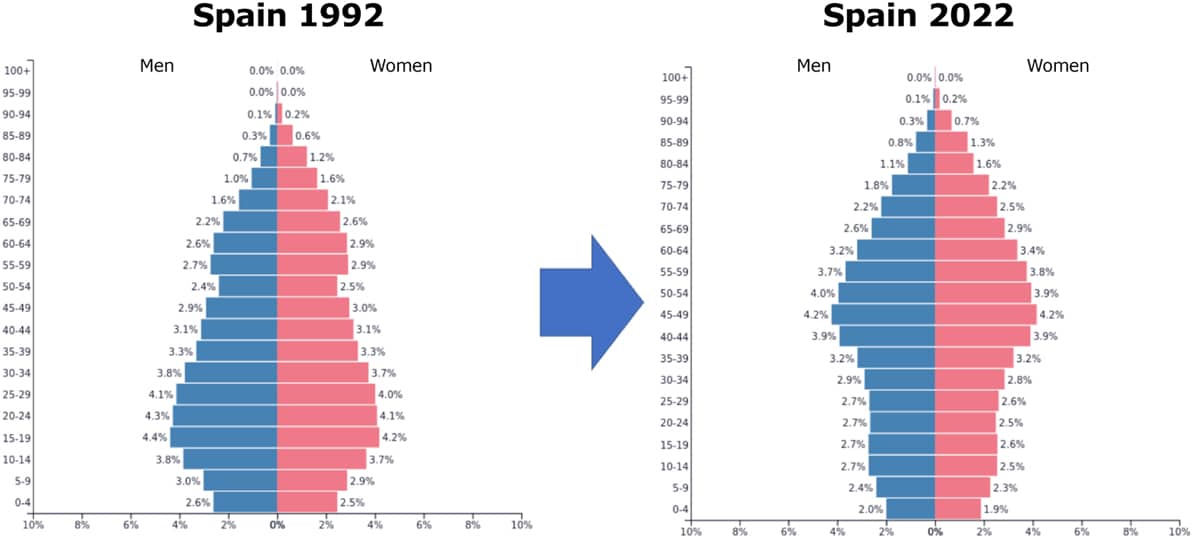

The aging of the population, a risk

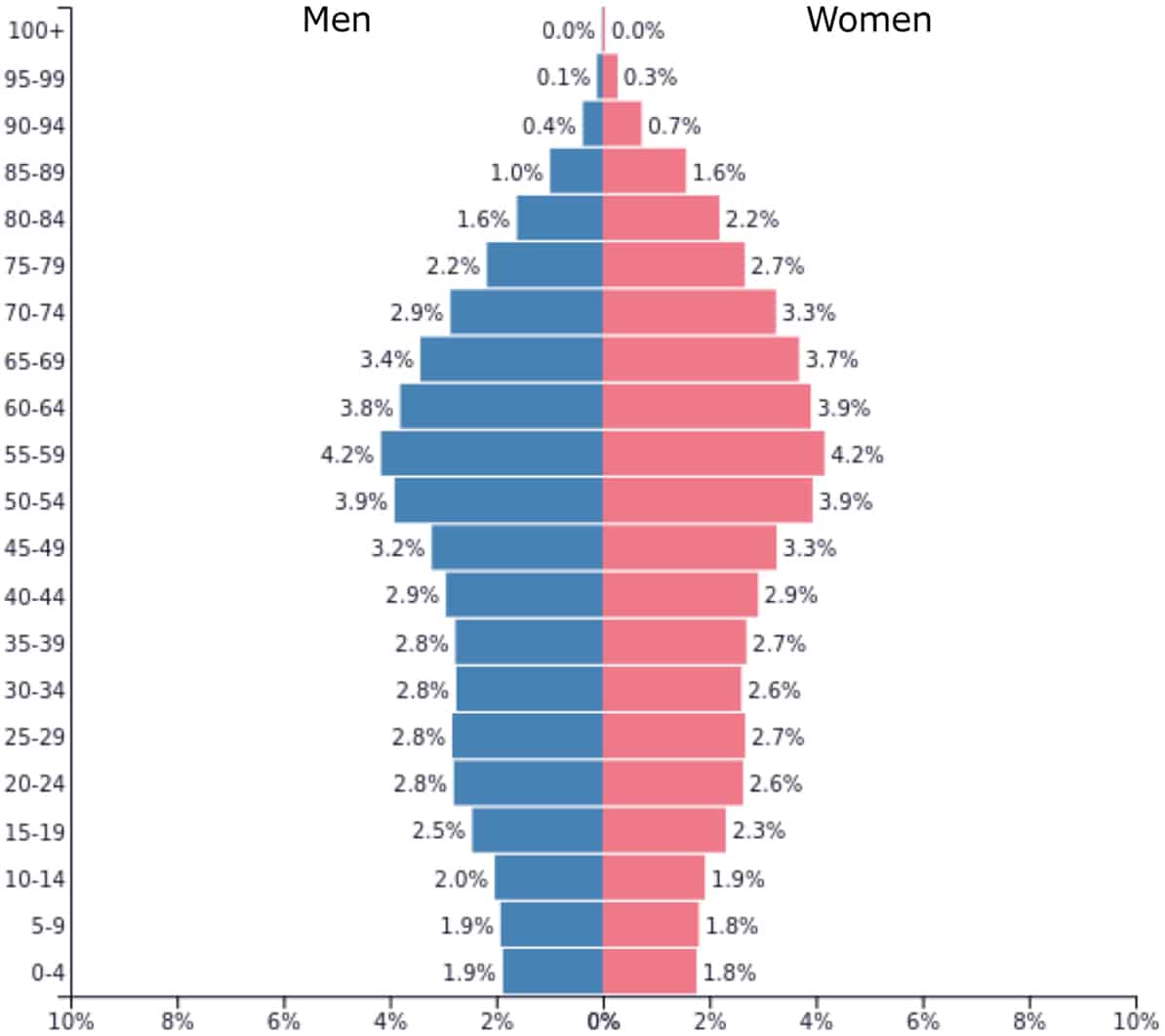

Spain is getting older. You only have to look at the population pyramid to realize this.

Source: Population Pyramids of the World from 1950 to 2100

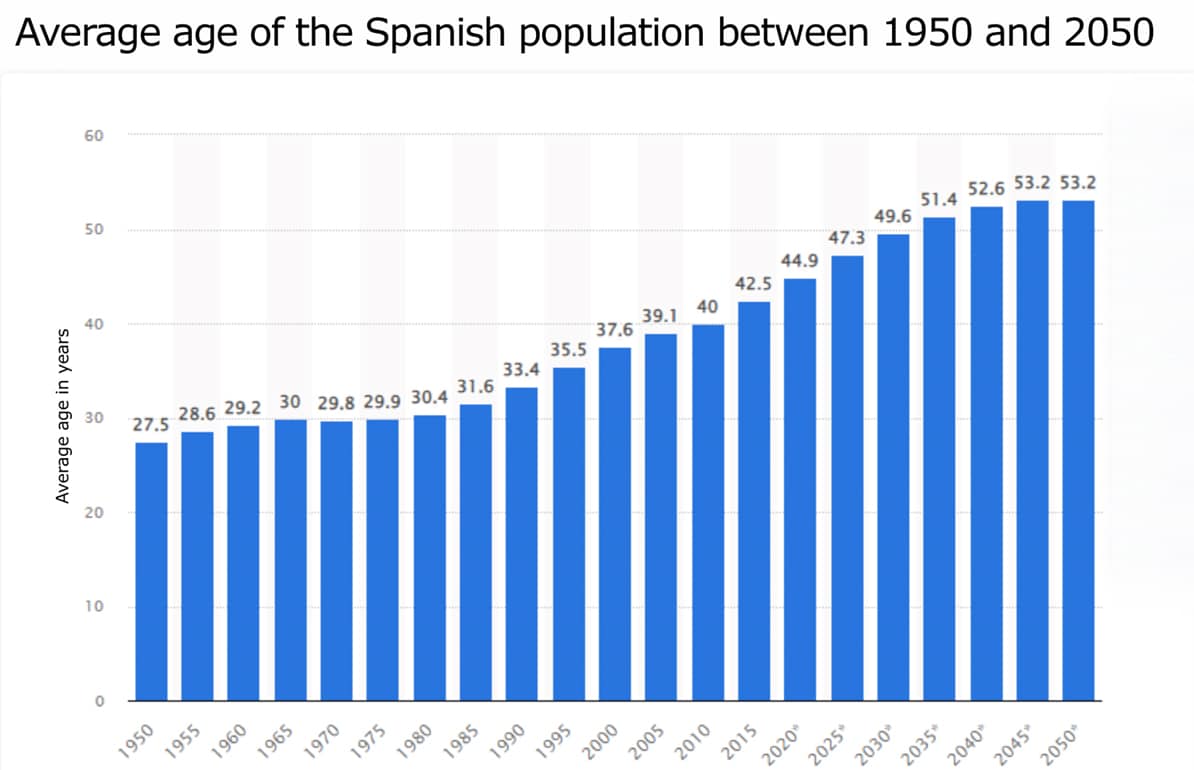

According to the Spanish National Institute of Statistics, the average age in the country is currently 44.1 years, a figure that will continue to rise because the birth rate is not high enough to slow down the aging of the population:

Source: Average age of the Spanish population between 1950 and 2050

With this evolution, the population pyramid in 2050 will look very different:

As you can see, the bulk of workers will be increasingly closer to retirement without enough contributors having joined to cover their state pensions.

In other words, the aging of the population and increased life expectancy will exacerbate the current imbalance in the pension system.

High pensions vs. declining wages

The country’s demographic evolution is the greatest challenge to the sustainability of the pension system, but it is not the only one.

As a complex model, there are other factors that influence the adequacy of pensions in Spain. One of these is the relationship between what pensioners receive and what workers are paid, which is directly related to what they contribute to the system.

To help you understand this better, remember that your state pension depends on the number of years you have made contributions (time you have worked), but also on the amount you have paid in. In other words, the higher your salary as a worker, the higher your future state pension will be.

At present, the average retirement pension is 1,375.23 euros per month in 14 payments, equivalent to 19,253.22 euros per year. Meanwhile, the average salary in Spain is 22,467 euros per year, but the median salary is only 18,556 euros per year and the most repeated wage is 13,531 euros.

In addition, there is already a generation gap in terms of wages between young people entering the labor market and those who have been in it for some time. In short, the new retirees receive increasingly higher pensions, but people entering the labor market receive lower salaries.

And why is this so important? Basically because Social Security contributions, which pay for the pensions, are calculated on the basis of the workers salaries. If wages are lower, a greater number of contributors will be needed to pay for each pension. In short, another source of friction.

What could happen to the pension system?

It is very difficult to answer this question. The pension system is not static, but evolves in line with the various regulatory changes.

However, there are a number of formulas for balancing the accounts and making the system sustainable:

- Increase social contributions to cover the deficit.

- Delay the retirement age.

- Limit pension amounts (present and future)

None of these seem like very popular solutions. There is also the possibility of a more profound reform that imitates the pension model of other countries, with a more limited state pension, but which encourages private savings through company pension plans or a system of notional accounts where the pension is paid from the contributions of each worker.

In any case, making the Spanish model, as well as those of other countries, sustainable is and will continue to be a challenge in the face of an aging population.