Evolution of pensions in Spain: amount and calculation

The Spanish pension system has evolved over time, from the first mandatory old-age or retirement insurance to the current pay-as-you-go system. This evolution, and the changes that have been implemented, are intended to ensure its sustainability and future.

This translates into more or less far-reaching regulatory changes, the constant evolution of how much the state retirement pension is, and even the emergence of new types of social security pensions and benefits.

Changes in the average pension

What you receive as your retirement pension is a reflection of all the regulatory changes, along with other factors, like your retirement age.

The amount of the state retirement pension is a reflection of how the pension is calculated. This includes your salary and the years you have worked over the course of your life.

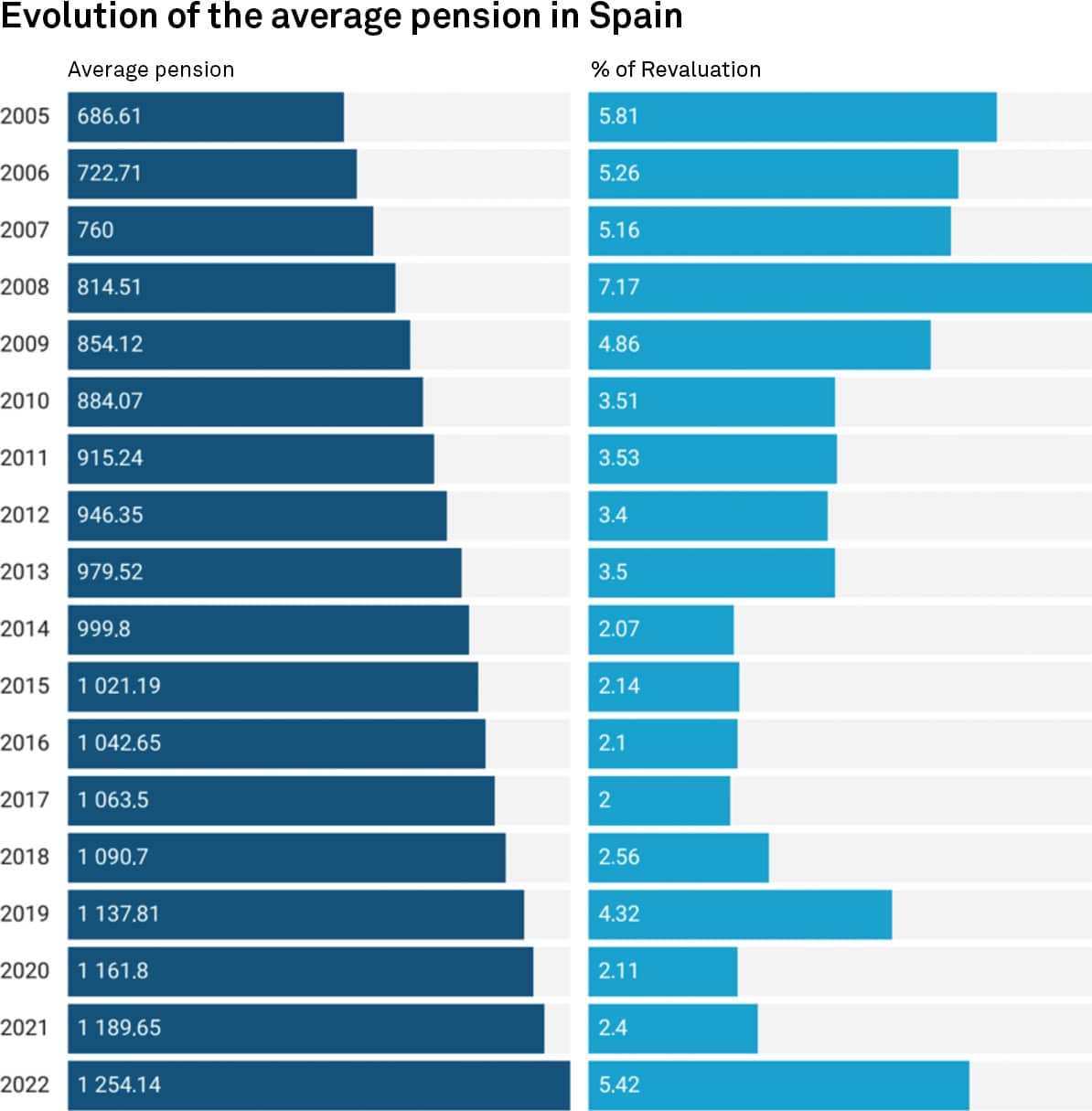

This is how it has changed and progressed over the years:

As you can see, the state pension has continuously increased. This growth has more to do with the increase in wages than with the updating of pensions. In fact, it is the main reason why the revaluation percentage varies so much each year.

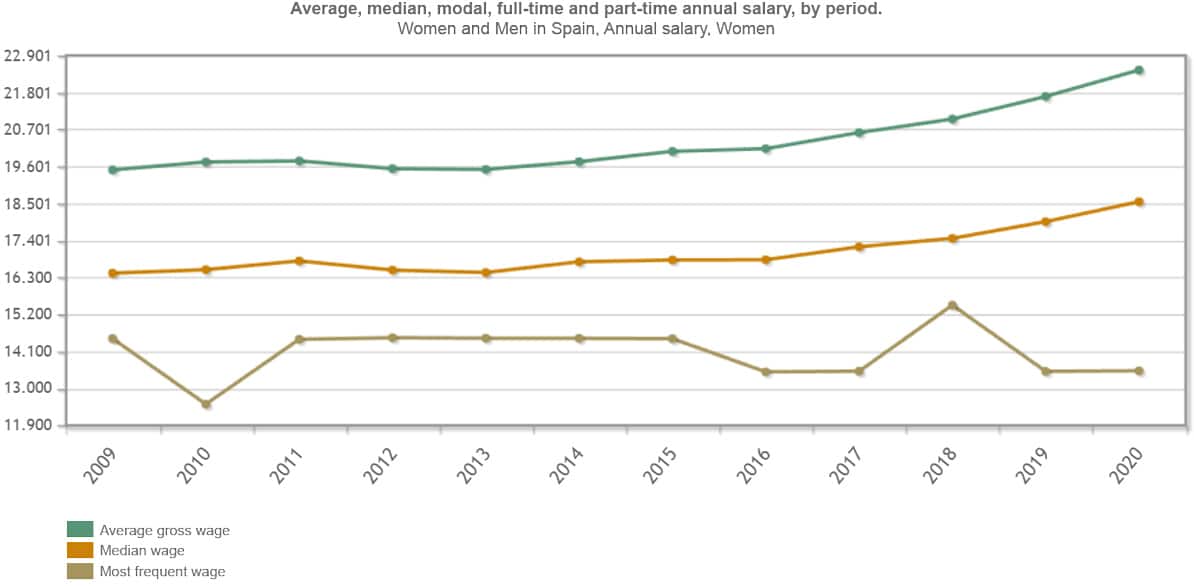

The stagnation of wages, as measured by the most frequently repeated wage figure, is likely to hold back this increase in the average pension:

The reason is that, unlike salaries, the pension amount is capped. In other words, there is no limit to how much you can earn, but there is a maximum contribution base and therefore a maximum pension established by law.

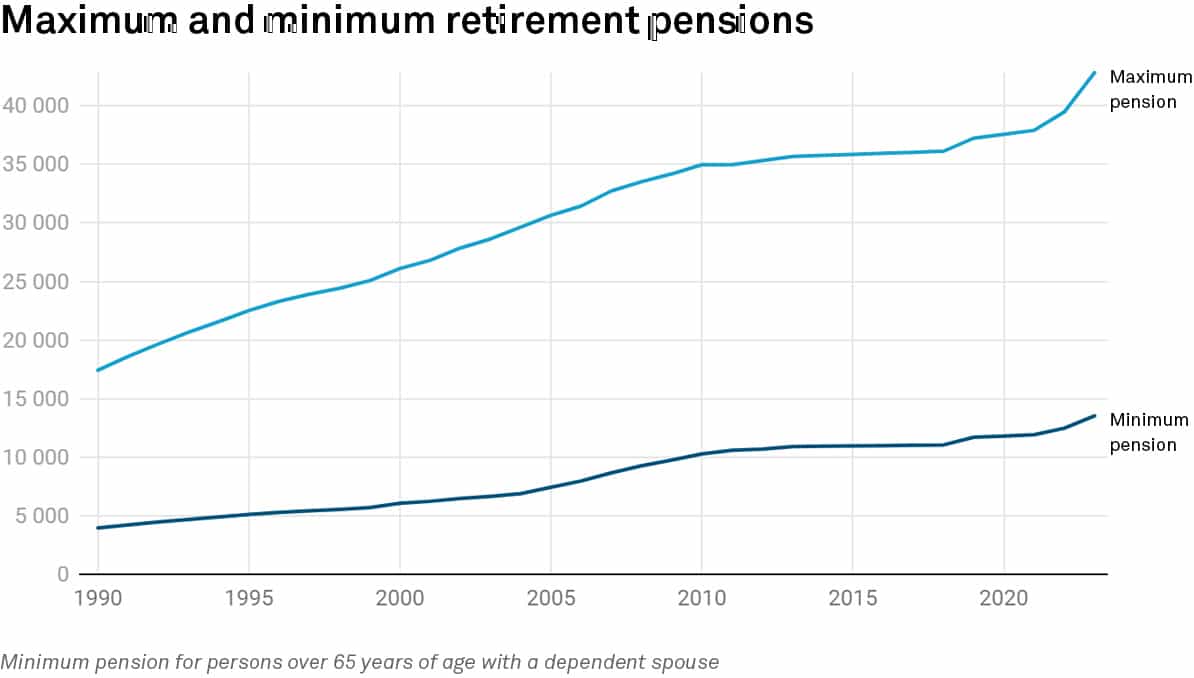

Evolution of the maximum and minimum pensions

The minimum and maximum pension amounts are not linked to salaries. The government is responsible for setting how much the minimum a pensioner should receive is, and also how much the highest pensions should be.

Both figures have evolved over time, although the focus has always been on the minimum pension amount.

Source: Ministry of Labour and Social Economy | Created with Datawrapper

Regulatory changes in the pension system

Just as the amount of pensions has changed, so have the system and eligibility conditions.

The two latest major reforms date from 2011 and 2023 and their aim is the same: to secure the future of our pensions and introduce changes related to updating the system and calculating the pensions themselves.

The 2011 reform is still underway. This is the one that started to push back the retirement age starting in 2013 and ending in 2027, when the figure will be set at 67, and the number of contribution periods required to retire will have increased accordingly.

| Year | Contribution periods | Age requirement |

| 2013 | 35 years and 3 months or more | 65 years |

| Less than 35 years and 3 months | 65 years and 1 month | |

| 2014 | 35 years and 6 months or more | 65 years |

| Less than 35 years and 6 months | 65 years and 2 months | |

| 2015 | 35 years and 9 months or more | 65 years |

| Less than 35 years and 9 months | 65 years and 3 months | |

| 2016 | 36 years or more | 65 years |

| Less than 36 years | 65 years and 4 months | |

| 2017 | 36 years and 3 months or more | 65 years |

| Less than 36 years and 3 months | 65 years and 5 months | |

| 2018 | 36 years and 6 months or more | 65 years |

| Less than 36 years and 6 months | 65 years and 6 months | |

| 2019 | 36 years and 9 months or more | 65 years |

| Less than 36 years and 9 months | 65 years and 8 months | |

| 2020 | 37 years or more | 65 years |

| Less than 37 years | 65 years and 10 months | |

| 2021 | 37 years and 3 months or more | 65 years |

| Less than 37 years and 3 months | 66 years | |

| 2022 | 37 years and 6 months or more | 65 years |

| Less than 37 years and 6 months | 66 years and 2 months | |

| 2023 | 37 years and 9 months or more | 65 years |

| Less than 37 years and 9 months | 66 years and 4 months | |

| 2024 | 38 years or more | 65 years |

| Less than 38 years | 66 years and 6 months | |

| 2025 | 38 years and 3 months or more | 65 years |

| Less than 38 years and 3 months | 66 years and 8 months | |

| 2026 | 38 years and 3 months or more | 65 years |

| Less than 38 years and 3 months | 66 years and 10 months | |

| A partir de 2027 | 38 years and 6 months or more | 65 years |

| Less than 38 years and 6 months | 67 years |

Source: Seguridad Social

Other measures contemplated in the 2011 reform were to specify the sustainability factor and the Pension Revaluation index. The latter decoupled the increase in the state pension from the CPI and established a new revaluation parameter that takes into account the Social Security’s income and expenditure, the annual rate of change in the number of pensions and the amount of pensions. It was applied from 2014 until 2018.

In turn, the sustainability factor was due to come into force in 2019, but this was delayed and was never finally implemented.

From 2019, work began on a new system which, following the recommendations of the Toledo Pact, has materialised in Royal Decree-Law 2/2023, of 16 March, on urgent measures to extend pensioners’ rights, reduce the gender gap and establish a new framework for the sustainability of the state pension system.

This reform seeks to guarantee the purchasing power of pensioners, improve minimum pensions, introduce equity factors into the system and, once again, underpin the survival of the system.

Its main measures include:

- An increase in the maximum contribution bases, which will rise in line with the CPI plus an additional percentage of 1.2% until 2050. This means that people who earn more will contribute more to the system than other workers.

- The introduction of a solidarity payment for the highest salaries that exceed the maximum contribution rate, which will contribute an additional 1% in 2025, rising to 6% in 2045.

- Introduction of the intergenerational solidarity mechanism, which means an additional contribution of 0.6% (0.5% from the employer and 0.1% from the employee), rising to 1.2% in 2050. The increase will be one tenth of a percentage point per year.

- Increase of the gender gap supplement for mothers and fathers who have been affected in their careers and therefore in their contributions due to their status as parents.

- Improved coverage of contribution gaps.

- New model for calculating the pension, allowing a choice between either the last 25 years or the last 29, eliminating the two worst.

| Year | New period | Eliminating the two worst |

| 2027 | 304 | 302 |

| 2028 | 308 | 304 |

| 2029 | 312 | 306 |

| 2030 | 316 | 308 |

| 2031 | 320 | 310 |

| 2032 | 324 | 312 |

| 2033 | 328 | 314 |

| 2034 | 332 | 316 |

| 2035 | 336 | 318 |

| 2036 | 340 | 320 |

| 2037 | 344 | 322 |

| 2038 | 348 (29 years) | 324 (27 years) |

All of these changes are intended to balance the Social Security accounts so that the system reduces its deficit and can function without additional contributions.