Money mistakes at 40

Is 40 the new 30? If you’ve ever heard it, you’d better forget it. As young as you may still be (at least relatively), it’s easy for your personal and professional circumstances to have changed over a decade.

You only have to think about your personal finances to realize that. You certainly don’t earn the same now as you did 10 years ago, and you certainly don’t spend in the same way, nor do you have the same responsibilities or goals. Every age has its specifics and also its typical money mistakes.

The classic financial mistakes at 40 are different from those made at 30. Here are the money mistakes to watch out for:

Not having a good financial cushion

Human beings are animals of habit and if you have been comfortable with 1,500 euros for emergencies in the bank since you were 26 years old, why would you need more money now? Because a good emergency fund should evolve as your expenses do.

Its purpose is to act as a cushion if, for example, you lose your job. That 1,500 euros might have been enough 10 years ago, but not at 40, when your expenses are likely to be higher, you may have a mortgage and even a family that depends in part on your income.

The same can apply to the amount of money you save every month, which should have been increasing as you got older and your income increased. If you haven’t already started, there’s still time. Here you can see how much you should save according to your age.

Buying your second home without having paid off your first

Taking out a mortgage for more than 25 years is one of the classic money mistakes. This is usually done around the age of 30, dragging the mortgage out almost until retirement. But that doesn’t stop most people from looking for a second home in their 40s.

There are two sides to this failure with money at 40:

- The first is to buy a second home for your vacations, especially if you have a family. The normal thing is to finance that house with a second mortgage, for which the primary residence acts as collateral.

The result is that if you stop paying for the beach house, you could even lose the house you live in. - The second aspect is a consequence of increasing expenses. In other words, as your income increases, so do your expenses. In the area of housing, it is common to move to a larger house without properly assessing the economic impact of this change.

The first is that you will once again pay taxes and expenses to buy the house, and the second is that you will again take on another mortgage and, in addition, you will usually increase the number of years of the mortgage.

Not having started planning for your retirement

Timeis your greatest ally and wasting it is one of the most common mistakes when planning your retirement, which is very much in line with the first money mistake at age 40.

That false dogma that you are too young to save, that there is still time to plan for retirement made no sense at 30 and makes even less sense at 40.

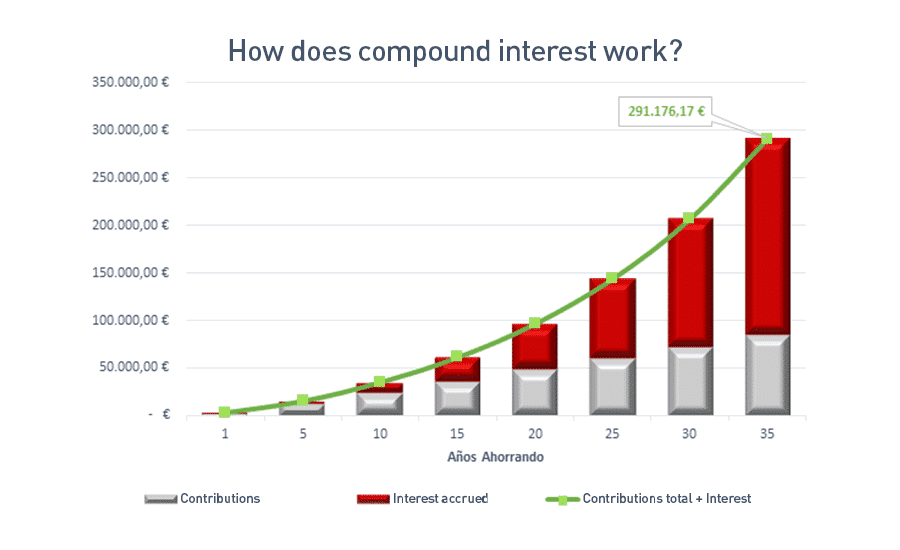

At this point you have approximately 25 years to plan your retirement, which may seem like a long time, but it is not long enough to really take advantage of compound interest. This chart will help you understand this idea better.

This is what happens with compound interest when you invest 1,000 euros at the offset and add 200 euros more each month at an annual return of 6%. The slope of the curve increases over the years and, as you can see, you still have time to take advantage of it.

Outlandish investments

Planning for retirement involves saving and investing according to a plan and not improvising as you go along. This is another of the financial mistakes made at this age: outlandish investments.

From setting up that bar you’ve always wanted with your friends to creating any other type of business based on what you liked when you were young. The reason for these investments is that at the age of 40 it is normal to take stock of your professional and personal life. Looking back, it is easy to feel that you missed that entrepreneurial experience, or simply be tired of your job. If you put this together with the feeling that almost half of your life has gone by, it will probably push you to take the leap.

And taking the plunge can be fine, but only if you’ve done the math, are clear that this is what you’re looking for, and have a financial safety net in case things go wrong.

Not having a plan for your debts

People who had debt in their 30s can easily carry this into the next decade of their lives. If this is your case, take advantage of the momentum of this change of cycle to remedy this situation.

The most typical is that these debts are personal loans for things like car or vacation, to which credit cards may also be added. Most often, the debt is under control and you may even be able to meet your payments on time. However, that doesn’t mean it’s the best thing for your finances.

Paying off your debts will immediately reduce your level of financial stress and increase your ability to save just when you need it most. To set your plan in motion, all you need to do is make a list of your debts, and choose the smallest one or the one with the highest interest rate if you think you can eliminate it in three months.

Not knowing how to plan for your real expenses

Do you know how much university costs for your children? You may have a rough idea and may even think it’s free because education is public. In any case, this is a really good example of the kind of expenses you can plan for, something you should be doing at this stage of your life.

Just as you can go ahead and save for your children’s college education, you can also plan for many other expenses that are bound to come up sooner or later. Home improvements, a new car, a new refrigerator… and even retirement expenses. If you’re thinking about a travel-filled retirement, you may not be able to afford it on a state pension, for example.

Stopping to think about these expenses will help you:

- Cope with them better, without going into debt and without them throwing your finances out of whack when they arrive.

- Not have to give things up and have everything as you would like it (because you have planned properly).

- Value them much more and not break the budget you set for them (especially in terms of consumer goods).

As you have just seen, all the money mistakes people make at 40 are easily avoided. Now you just have to do something about them or sort them out.