The sum insured

The value attributed by the policyholder to the property is called the sum insured, which is the maximum limit of indemnity to be paid by the insurer in the event of a claim.

Within this concept, there are two distinct components:

- The value of the policyholder’s asset: this is the market price of the insured asset, in other words, the cost of the asset.

- The insurable interest: this is the economic relationship between the policyholder and the asset protected in the policy.

In order to be fully insured, there must be “insurance at actual cash value”, that is, the amount stated in the policy must accurately reflect the value of the asset. In the event of a claim, the indemnity will fully coincide with the value of the damage suffered.

Occasionally, the sum insured may or may not coincide with the value of the interest; in this case, situations of overinsurance and underinsurance arise.

Overinsurance

Overinsurance exists when the value attributed to the policyholder’s insured interest is higher than its actual value.

In the event of a claim, the insurance cannot result in unfair enrichment for the policyholder, therefore, they cannot receive more compensation than that corresponding to the true value of the asset and the amount of the damage. Even if the policyholder values an asset above its true value and pays a higher premium for it, they can never receive a higher indemnity than the true value.

For example, a policyholder insures a shipment of goods that they value at 100,000€. During transport, the goods suffer significant damage and lose all their value. When the loss is processed, the loss adjuster determines that the actual value of the merchandise was 70,000€, so the indemnity to be received will only be 70,000€.

Underinsurance

Underinsurance occurs when the sum insured stated in the policy is less than the value of the insured interest.

If the policyholder wishes to be fully insured, this situation must be avoided, since in the event of a claim the policyholder cannot receive more compensation than that corresponding to them, even if it is insufficient to repair or replace the asset.

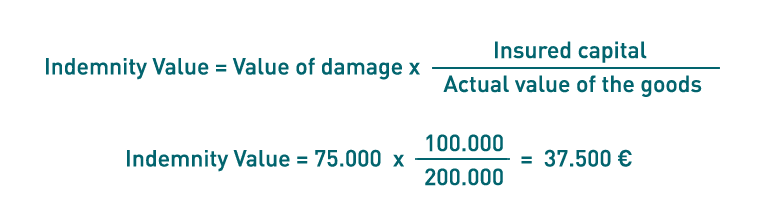

In order to remedy this situation, the so-called “proportional rule” is applied, whereby the proportion by which the policyholder must be compensated in the event of underinsurance is calculated.

A policyholder insures a shipment of goods valued at 100,000€. During transport, the vehicle is involved in an accident and the goods are damaged to the value of 75,000€. When processing the claim, the loss adjuster determines that the actual value of all the goods (before the accident) was 200,000 €, so that the indemnity to be received will be (as a result of applying the proportional rule)