What to do with your children’s money? Investing for your children

Every parent is concerned about their child’s future, and there is no doubt that finances are an important part of this. So sooner or later the same question always comes up: what should I do with my children’s money?

Most people will choose to open a children’s savings account, which may be a good starting point, but perhaps not optimal in the long run. The advantages of children’s savings accounts are very clear:

- they are easy to understand and manage in terms of regular contributions made by you or your relatives (gifts to children from grandparents and aunts and uncles, for example).

- you know what you are going to get and there are no risks involved.

- you or your child can easily withdraw money when you need it (be careful, because this can be a disadvantage if you don’t teach your child well).

- your child will see clearly how much money they have and how it grows as they save.

But despite all these advantages, there is a big disadvantage that can actually outweigh all of them: it wastes all the time children have ahead of them for making their savings grow thanks to compound interest.

Also, as safe as these accounts may be, remember that although the money will not lose its nominal value, it will lose its real value due to inflation. In other words, even if after 10 or 15 years you have 9,000 euros in your account, that money will be worth less because the cost of living increases year after year and you will be able to do less with it.

What to do with your children’s money?

If a children’s savings account is not the best thing to do with your children’s money, then what is the solution? To invest it so that it generates a good return year after year.

The reason for investing children’s savings is very simple: they have a lot of time ahead of them. They have a lifetime, in fact, and if there is one ally of the small investor, it is time.

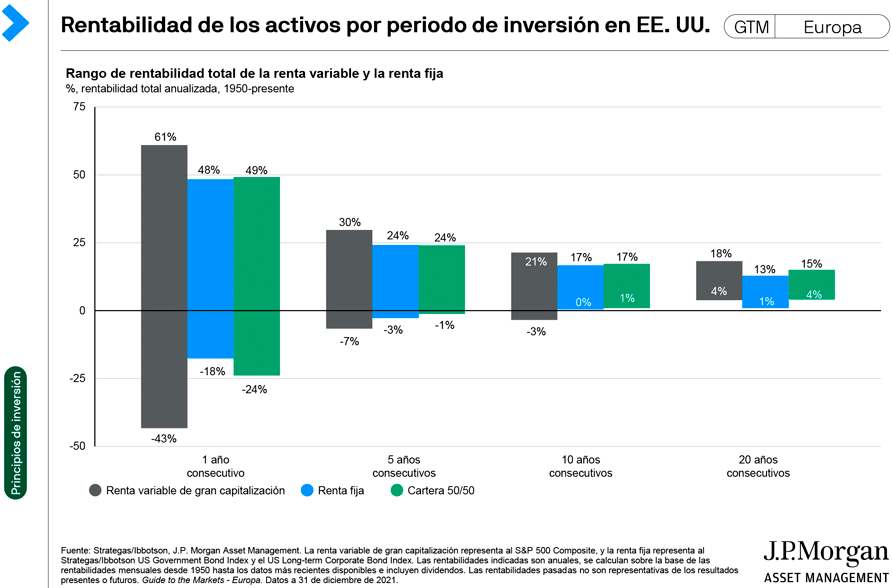

The length of time over which you invest is key to the risk-return ratio of investments. In a nutshell, the longer the term of an investment, the less likely you are to lose money. That is the effect of long-term investing.

This chart from JP Morgan sums it up pretty well.

As you can see, the chances of losing out are drastically reduced after 10 years. And if we are talking about savings for your children, 10 years is a more than reasonable timeframe for them, and could even be short if you start their financial plan as soon as they are born (which we recommend you do).

Of course, this does not mean that all investment risks disappear. In fact, the market will go up or down as it has always done, but neither you nor your child will care if at the end of the day the result is worth it.

To limit these risks a little more, you can use two very simple tools.

- Invest regularly , something that is ideal for little ones. Instead of contributing 10,000 euros as soon as your child is born, you can set aside a small amount each month and allocate it to their investments. This way you can take advantage of the magic of regular investment.

- Adjust investments to the timing of the payback. This means that you can take more risk at the beginning, because you will have time to recover from any downturns, but you will have to limit that risk (and the potential return) as it gets closer to the point when you get your money back. The practical translation of this is that as your children approach the age of 18 or whatever age you have set for yourself, you will need to rotate the investment towards a slightly more conservative profile.

What can you achieve? An example

So much for the theory. The best way to understand what you can achieve is with a practical example. What is the difference in euros between a traditional children’s savings account and doing something else? Let’s take a look!

Let’s imagine that you start with an initial investment of 1,000 euros to which you add 50 euros per month, and that you will get the money out when they are 18 years old, for university, for example.

By the end of this time with a savings account, you will have 11,800 euros without deducting the effect of inflation. So you know what you are getting. No catch, no fuss.

What if you invest that money? Everything will depend on your investment profile and the return you can obtain. To crunch the numbers, let’s assume that during the first 13 years you are able to obtain 6% a year (less than the average for the stock market, discounting expenses), and that during the next five years you move towards a more conservative profile and obtain a return of 3%.

At the end of 18 years you would have 19,675 euros, almost 8,000 euros more than with a savings account. That is the difference between saving for your children or saving and investing.

Where should you invest your children’s money?

The market offers plenty of options for making your children’s money profitable, depending on your financial knowledge and investor profile.

Here are some of the alternatives:

- Investment funds. One of the easiest alternatives if you opt for a portfolio managed by experts, although it is also affordable if you prefer to do it on your own (if you like it and have the time and knowledge). In this article we summarise what investment funds are, as well as their advantages and disadvantages.

- Index investment funds and ETFs. Another type of investment fund that is characterised by replicating the market. Instead of looking for the shares that are going to rise the most, as a traditional fund would do, what this type of fund does is to mirror a stock market index such as the Spanish Ibex 35. Studies show that in the long run few active (traditional) funds are able to outperform the market. The advantage of this option is that you will normally pay less commission.

- Savings insurance. Another option within everyone’s reach, as these are professionally managed products that do not require a lot of money to start investing.

- Direct investment in the stock market. This is the alternative for which you will need the most knowledge, as it is usually you who chooses the shares in which to invest. It is also the least automated, because every month, quarter or whenever you choose to invest, you will have to analyse which companies you are going to invest in.

- Dividend investment. A variant of stock market investment. This basically consists of looking for companies that pay out dividends every year and that do so on an increasing basis. The difference with the previous option is that there are many groups and lists of these companies and that, thanks to the dividends, you can generate a regular income for your child.

Finally, the last thing to do is to decide whether to put the money in your name or in the child’s name. Apart from certain tax implications, the key choice is a matter of trust. In short, whether you want your child to have access to the money at 18 because it is theirs, or whether you want to be the one to decide how and when you give it to them, no matter how old they are.