The importance of the investment time frame

Would you consider losing 10 kilos in a month? And running 10 kilometers if you have never put on a pair of sneakers? Of course not. What’s more, you shouldn’t either: both would pose a significant risk to your health.

It’s a similar story with your finances. The goal you set for yourself is as important as the time frame in which you want to achieve it. If you try to move too fast, you will have to take on more risk. That’s why, when investing, doing it in the long term has many advantages and makes sense for ordinary savers.

In fact, one of the things you should decide before investing is the time horizon over which you are going to do this.

What is an investment time horizon?

The time horizon is how long you are going to keep your money invested. This means, the length of time you can do without that part of your savings in order to generate profitability through your investments.

Knowing this time horizon is important to be able to adjust your investment objectives to the risk you take on. To make this clearer, if you want to double your money in 1 year, you will have to invest and assume different risks than if you want to achieve this in 10 years.

In the first case you will need an annual return of 100% and in the second of 7.2%. Do you see the difference?

This is precisely why each investment product has its own recommended time horizon in order to offer results in accordance with the risk you bear. To make it easier for you to choose and to determine the time frame for your investments, there are usually three different time horizons.

- Short term for investments in which you want to get the money back in less than a year.

- Medium term for investments with a horizon of between one and seven years. That is the time you estimate you will not need this money for.

- Long term for investments of more than eight years, although ideally more than ten.

These are general limits, although you can (and should) adjust them to your needs. For instance, for you the short term could be two years if you know for sure that you will need the money in that time. For example, if you have saved capital that you are going to use to buy a house in two years time.

How does this horizon affect your investments?

The length of time you plan to hold the investment plays a decisive role in determining the risk you can or should take on.

Just as you would not start a game of Monopoly if you knew you had to leave in 20 minutes, you should not invest your money in highly volatile products, where the price moves a lot and quickly, if you know that you will need it in three months to change your car, for example.

The reason is simple, in short-term investments you do not have the luxury of time to recover in the event of a fall in the market. As a consequence, the focus of short-term money should be stability and protection. That means being able to recover what you have invested, even at the cost of lower returns.

Anything that strays from this vision is equally valid, but is more a matter of speculation than investment, and you must be aware of the risks involved: you may not get all your money back when you need it.

What happens when you invest over more time? The approach changes and you can add in more risk or potential return, depending on how you want to look at it. As an example, if you invest 20 years ahead, you have a lot of time in which to correct mistakes, so you can invest in more volatile assets.

In other words, you can focus on profitability and not on preserving your capital. Later, as that time horizon shrinks, you can adjust your risk to your new reality. One way to do this is with the rule of 120.

The longer the time horizon, the better the risk-return ratio

No-one knows what will happen in the markets tomorrow and anyone who says otherwise is probably wrong. What we do know, because there is statistical data, is that the stock market generally has an upward trend and that the longer the time horizon of the investment, the less chance there is of losing money.

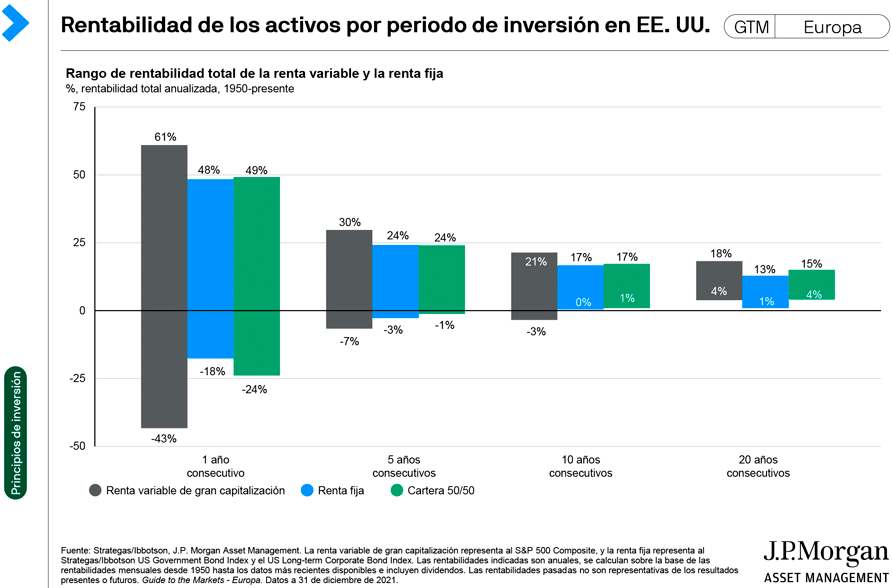

The following diagram from JP Morgan illustrates this perfectly.

Since 1950, one year forward variable rate investments have yielded returns of up to 61%, but also losses of 43%. Extend the period to 5 years, medium-term investments, and those differences are reduced. Take it to 10 years and the difference is even less. Invest for 20 years and you will no longer lose money.

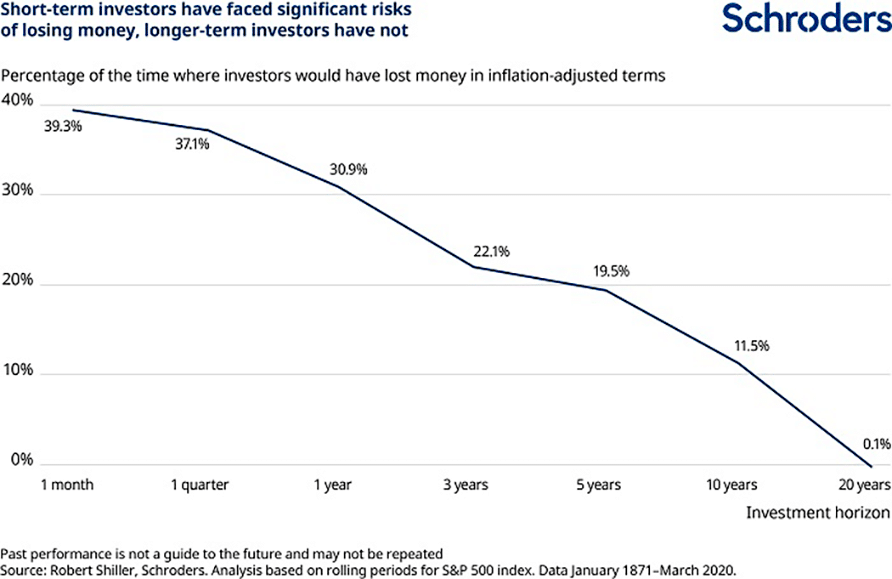

That’s what the numbers say Schroeders sum it up like this.

As you can see, the possibility of losing money decreases dramatically as the investment term increases. That’s the effect of time on your investments.

And it’s not just about risk, it’s also about return. There are two other elements that favor long-term investing.

The first is compound interest, which is simply reinvesting the returns you earn. Compound interest is one of the biggest tools for making your money grow and it only needs time to work and create a snowball effect.

Thanks to compound interest your savings grow faster and faster until the time comes when the interest generated by your investments can exceed the money you have put in.

For example, if you invest 10,000 euros with an annual return of 8%, after 20 years you would have 46,609.47 euros, more than three times what you contributed, and in the last year you would have generated around 3,500 euros in interest alone.

The second key element is commissions. You will always have to pay these fees, but normally a short-term strategy will involve more movements to adjust your portfolio to what happens in the market and, therefore, more commissions. Investing for the long term allows you to fine-tune this aspect.

Why invest long term?

Beyond what the numbers say, the long term is where you should focus as an investor for purely personal reasons.

Stop and think for a second about your big goals in life: buying a house, having a dream retirement, your children’s education, traveling around the world… Do you see what they have in common? Most are focused on long-term things, which you won’t achieve in a year or two.

In the worst case, we are talking about medium-term goals. And if your goals are for the medium and long term, doesn’t it make all the sense in the world to invest within this time horizon as well?

Think about the money for your children’s future. There is an 18-year difference between when they are born and when they will need money for university. Invest this money for the long term, in volatile assets and yes, its price will fluctuate, fall and rise. However, that will matter little to your child, who will have enough to grow, learn and develop their personality.

The only thing they will see is the overall result at the end, not the ups and downs and bends in the road. This is how you should approach your long-term investments. It is easier said than done, but to enter the world of investments you just have to take the first step.