How to get your money back when you retire

Most tips for enjoying retirement focus on how much money you’ll need and how to get it. However, good planning cannot overlook what happens next. Having a clear understanding of how to get your retirement money back when the time comes is more important than you think.

In fact, a good disinvestment strategy serves to adjust your savings and investment effort up to your retirement. In other words, it can mean you need less money than you think for your retirement.

In addition, it can also help you avoid some tax, as long as you know how to organize yourself.

Two general tips

Before we get into specific strategies for getting your retirement savings back, there are two general keys to keep in mind that will help you plan the entire divestment process.

You still have a lot of time ahead of you, including for investing

The legal retirement age in Spain is set at 66 and will reach 67 in 2025, while the average life expectancy is 82 and rising. This leaves a margin of 15 years on average, which in investment terms is already considered long term.

In short, there is still room to invest part of your capital after you retire as part of your divestment strategy. Not surprisingly, this is precisely what is proposed to a greater or lesser extent in many of the strategies you will see below.

Of course, investing does not mean having your entire portfolio in equities or stocks, nor does it mean maintaining the same investor profile as when you were 60, for example. Your investment risk should be adapted to your age, your needs and your risk aversion. In this article we explain how this tends to evolve at each stage of life.

Think about tax

Getting your money back when you retire means paying taxes and depending on how you do this and with which products you will pay more or less. Even the amount you recover each year is important when it comes to paying tax.

The reason is that personal income tax tables work progressively, both for income from work (your pension and money from pension plans) and for savings income (your investments).

| General base income rates | ||

| Taxable income | Rate to apply | |

| From | To | |

| 0 € | 12,450 € | 19% |

| 12,450 € | 20,200 € | 24% |

| 20,200 € | 35,200 € | 30% |

| 35,200 € | 60,000 € | 37% |

| 60,000 € | 300,000 € | 45% |

| More of 300,000 € | 47% | |

| Savings rates | ||

| Total earnings | Rate to apply | |

| From | To | |

| 0 € | 6,000 € | 19% |

| 6,000 € | 50,000 € | 21% |

| 50,000 € | 200,000 € | 23% |

| 200,000 € | 300,000 € | 27% |

| More of 300,000 € | 28% | |

This means that the more money you recover in the same tax year, the more you will pay in taxes. The easiest way to understand this is with investments included in the savings base (Rendimientos del Capital Mobiliario y Ganacias de Patrimonio).

If you recover an investment whose return is 5,000 euros, you will pay 19% tax on that return. However, if it were 10,000 euros, the tax bill for the last 4,000 euros will not be 19%, but 21%, three points more.

And the same happens with the money from your state pension and pension plan, except that here it is income from work, included in the General Base, and taxed at even higher rates. It should also be borne in mind that when redeeming Pension Plans, everything is taxed, not only the yield.

That is why it is important to do tax calculations.

As this article from Value School reveals, there is even a maximum annual income that you can collect without having to pay taxes, which is around 18,000 euros split between your pension and other types of income.

Alternatives for recovering retirement savings

There are several strategies and products for this disinvestment phase where the objective is to get your money back.

These are five of the most common options with a final piece of advice if you have invested in a pension plan.

As profit or loss: the 4% rule:

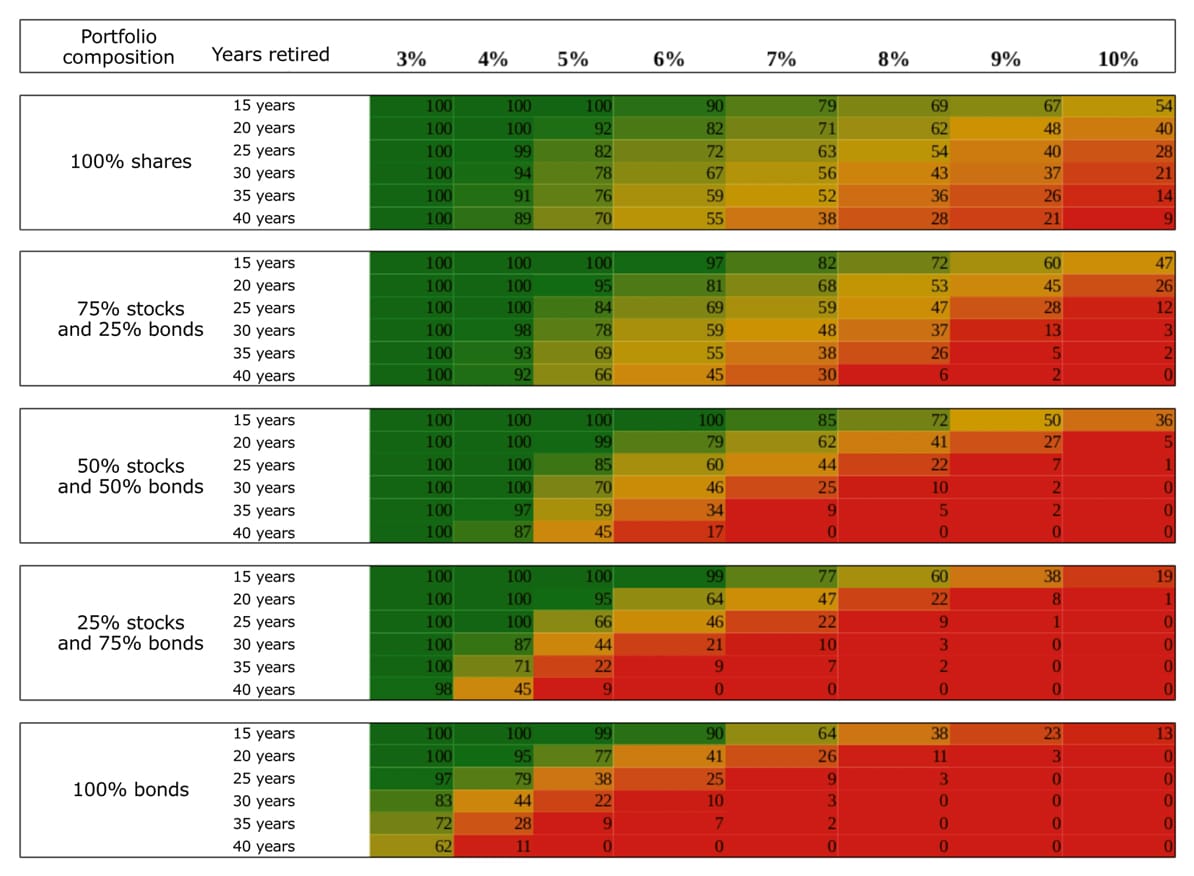

This strategy applies to investments that generate capital gains or losses such as mutual funds or stock market shares. It is a calculation that is used to find out how long your savings will last depending on how you invest them and how much money you take out each year. This is what is known as a safe withdrawal rate.

It is called the 4% rule because that was the optimal withdrawal rate when the initial study was conducted. This research was carried out for the first time in 1994 by Professor William Bengen and continued in 1998 at Trinity University.

Basically, the 4% rule calculates how much money you can withdraw each year depending on how it is invested (in a stock portfolio -variable income- or in a bond portfolio -fixed income-) and how long the capital will last in each case.

The best way to understand how this strategy works is with this chart showing data up to 2018:

Is 4% still the magic percentage today? Well, as you see, the answer depends on how you invest your money (the percentage of fixed income and variable income) and the years you want it to last. At this link you can see the study with updated data.

Life annuities: make sure you outlive your savings

If you’re not big on doing calculations, you can take out a product where the experts will do them for you and ensure that your savings will not run out for as long as you live. In other words, you always receive a monthly income. The name of this product gives a clear idea of what it is: life annuity.

An annuity is an insurance contract whereby the insurance company agrees to pay an amount to the insured person based on a starting capital, for as long as they live.

So that you understand it better, the basic operation of a life annuity is the following. Through an initial amount that you put in, the company uses actuarial techniques to calculate the periodic income that you can receive throughout your life and guarantees that payment until you die. It’s that simple.

From there, the contract can be completed with different clauses, since there are various types of life annuities depending on whether or not you want the unconsumed capital to go to your heirs or not, for example. Depending on elements like that and, of course, your age, and the initial capital, the amount you receive will be greater or less.

This is what a life annuity is in essence. Its advantage is that it ensures you will receive money for life, as well as certain tax benefits.

Specifically, a good part of the money you recover will be exempt from income tax (the later you draw out the annuity, the greater the tax advantage), as shown in the following table:

| Age when taking out the annuity | Tax-exempt income | Income subject to taxation |

| After 70 | 92% | 8% |

| Between 66 and 69 | 80% | 20% |

| Between 60 and 65 | 76% | 24% |

| Between 50 and 59 | 72% | 28% |

| Between 40 and 49 | 65% | 35% |

| Less than 40 | 60% | 40% |

In practice, this means that, if you withdraw the money from your investment funds, from a PIAS or from investments in stocks or bonds, a good part of the benefits you have generated will not be taxed if you receive them in the form of a life annuity.

The above tables do not apply when the annuity is set up with the money accumulated in a Pension Plan or a PPA (Insured Pension Plan), since these are considered to be income from work, and therefore not tax exempt.

Dividends: generate a periodic income

Another alternative for getting your money back or, rather, to ensure a regular income is to invest in stocks or bonds and periodically collect dividends or coupons, which is one of the most common variants of investment in the stock market or fixed income.

The dividend is the part of a company’s profit that it distributes among its shareholders, and some companies have a very clear policy in this regard. For example, the so-called dividend kings are US companies that have increased their dividends every year for at least 50 years.

With this formula, each year you are guaranteed to receive the income generated via dividends or coupons from the companies you have invested in, without actually having to sell your shares. There are even investment funds that follow this strategy, the so-called distribution funds, which distribute the dividends from the shares they hold in their portfolios among their participants.

The main drawback of this formula for ensuring a supplementary income is that it involves certain tax formalities if the assets are held by foreign companies, due to double taxation, and if you deal directly in shares, you will need knowledge and time to manage the portfolio.

Generating real estate income

Another way to divest your capital and ensure an income is to allocate part of your money to real estate investment. The most common formula would be to buy a house to rent out.

The drawbacks of this strategy are:

You will pay taxes when you get the money back and buy the house, as well as on the income you receive.

If you do it when you retire, you will (normally) have to buy the house without a mortgage.

This could pose a diversification problem, since you will usually only be able to invest in one or two apartments. What would happen if they stop paying you rent?

As a non-liquid investment (a house cannot be sold from one day to the next), it can be a handicap if you need more money than you get in rent, for whatever reason.

An alternative or complement to this strategy, or indeed any of those we have seen above, is to invest in REITs or Socimis. These are listed companies specializing in real estate investment and which, by law, are obliged to distribute the majority of their income in the form of dividends.

If you have a pension plan, think about it carefully

Finally, if you have a pension plan, it is important that you carefully consider how to retrieve your money because, depending on the formula you choose, you will pay more or less tax.

In short, you can redeem the plan in the form of capital (all at once), as income (little by little) or as a combination of the two. From a tax perspective, the second option is usually the most beneficial because pension plans are taxed as earned income -they are added to your state pension. As personal income tax (IRPF in Spain) is a progressive tax, if you withdraw everything all at once, it is easy to end up paying tax in the highest bracket.

In this article we explain the best option for withdrawing you pension plan and how it is taxed.