Money mistakes at 20

If you’re going to make a mistake, it’s better to make it early. This is an often-repeated phrase in startups and companies when launching new products. With your finances, it’s always better not to make mistakes, but if you’re going to (and you will), there are money mistakes that are better made in your 20s than in your 30s or early 40s.

There are personal finance lessons that aren’t taught in school. Even if they were, the gap between theory and practice is so large when it comes to money that it would be complicated to put them into practice.

Making money mistakes in your 20s is normal and can be positive as long as you learn from them. Here are the most common ones:

Spending too much on your car

The car is a status symbol in your 40s and also in your 20s. Having a car can make all the difference when it comes to making plans at that age, as well as affecting your pocket.

One of the most common mistakes is to spend too much on a car by buying a very expensive one, by tuning it or filling it with extras, or by getting long-term financing for it.

All three are mistakes from which you can learn. The first two should teach you to be clear about your priorities in life and focus your money on them. The car may actually be a priority if you really like it, or maybe not if all you need is a means of transport.

From the third mistake you can learn the dangers of debt. In other words, why you shouldn’t buy things you don’t really need with money you don’t have. Financing your car in the long term can turn a 12,000 euro vehicle into a total expense of 16,000 euros or more.

Thinking that saving is for later

“I’ll save when I earn more money.” This phrase is not exclusive to youth, but it does tend to be more frequent. In your 20s, plans and leisure options abound, meaning that saving requires an extra effort, especially in the long term.

However, there is no better time to get into the habit of saving than when you are young. This is because, once you do, you will never stop. The most effective formula for achieving this is to save automatically, as we explain in this article.

A good strategy for maintaining your savings impetus over the years is to save at least 25% of your salary increases. That way you avoid falling into an upward spending spiral and ensure that your savings increase as your income does.

Focusing on saving and forgetting about investment

Everyone more or less agrees about the need to save, especially in the short term. The same is not true for investment, especially when you are young. At the end of the day, retirement is a long way off, as are other goals, like stopping work at 40.

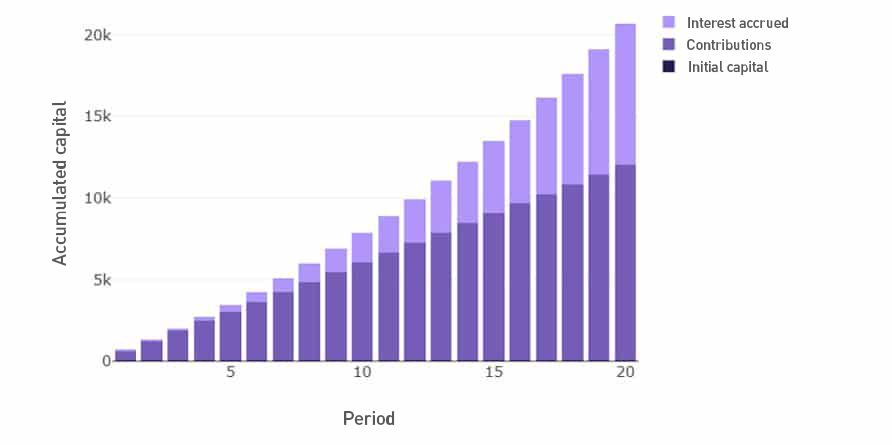

However, that investment is what will make the difference in the long run. If, aged 20, you started saving and investing 50 euros a month at an annual return of 5%, at the end of 20 years you would have 20,687 euros, of which more than 8,000 euros would be just interest.

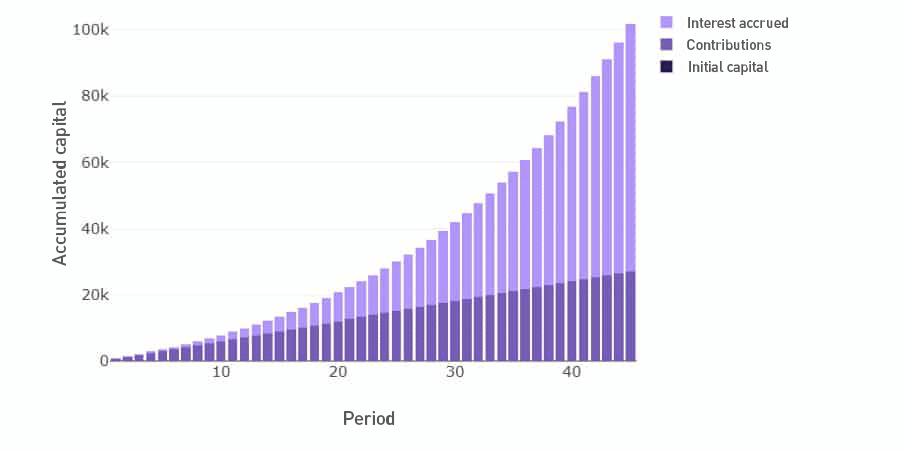

This is the magic of investment and compound interest, which just needs time to bear fruit. And that is precisely what you have when you are 20, a great deal of time ahead of you to take advantage of this fantastic tool. To help you understand it better, look at what would happen if, instead of investing until you are 40, you continue to do so until you are 65.

Not controlling your expenses and income

This is another mistake that is not exclusive to 20-year-olds, although it may be more pronounced. At the end of the day, it’s easy to think that when you are 20 and living at home with your parents, you don’t need a budget or any other kind of tool to keep track of your income and expenses. Nothing could be further from the truth.

Budgeting is a useful exercise at any stage of your life. It helps you to know how and on what you spend your money. At your age, you will discover many of the so-called “ant expenses” that prevent you from saving and give you the feeling that money is slipping through your fingers.

Becoming independent too young or not taking advantage of living in your parents’ home

It is not so much a question of hanging on against all odds at Mom and Dad’s house, nor of abandoning the nest as soon as you can; the ideal time to become independent is when you have a small savings cushion for emergencies and a steady income.

In fact, a very common (and understandable) mistake is to waste those years when you are working and still living at home with your parents. This is a stage where you could save a very high percentage of your salary without affecting your quality of life.