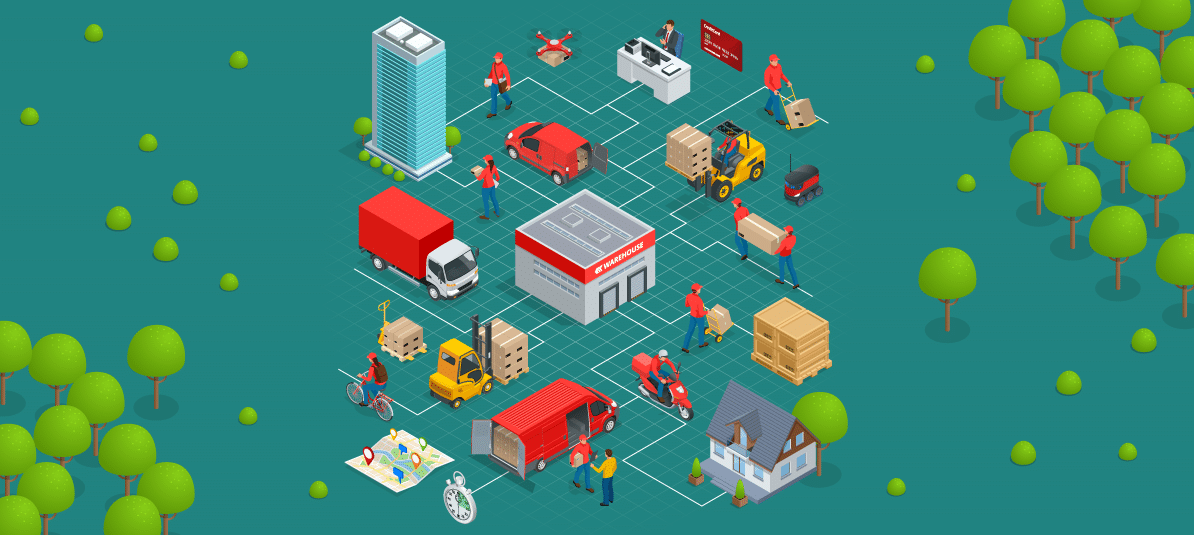

Tractors, buses, vans, delivery motorcycles, off-road vehicles, quads, freezer trucks, tanker trucks, concrete mixers, or simply, cars for employees to get around: many companies need vehicles to carry out their daily activities. Have you ever stopped to think about the number of business vehicles you might see in a single day?

A higher risk

This type of vehicle, just like private ones, must have compulsory insurance to drive on the roads. However, it should be noted that business fleets carry a somewhat higher risk, mainly due to the greater use that is generally made of these vehicles. In addition, in the case of businesses involved in goods or parcel deliveries, or companies whose own distribution network is supported by their fleet, any breakdown or mishap directly affects their bottom line.

All-in-one

As you can see, having the right policy for each fleet is very important, which is why the insurance sector offers various solutions to protect the business activities of these companies, help them save costs, and facilitate management. In addition to being able to adapt the policy to the circumstances and characteristics of each business, this type of insurance also offers great savings by allowing all the vehicles to be covered by a single contract.

What is a fleet?

Insurance companies establish the number of vehicles that they would consider to be a business fleet. Usually the minimum number is ten. Depending on the size of the fleet, conditions and coverage may vary. Covering the risks of a fleet of pizza delivery motorcycles is not the same as covering the risks of a company that transports hazardous substances. Nor is it the same to design coverage for fleets made up of the same type of vehicles as for companies that have mixed fleets (cars, motorcycles, vans, etc.). For this reason, the flexibility and adaptability of insurance is so important in this case.

Drivers

Of course, the drivers must not be forgotten when it comes to configuring these types of policies. Only the people authorized to drive the vehicle will be covered by the policy in the event of an accident and, in some cases the insurer may determine a series of requirements that these drivers must meet.

Protection, assistance and security to ensure your business activities keep going!