It is not certain when this rise will come or if there will be more than one before the end of the year, but what does seem clear is that the price of money and interest rates will not remain at 0%. That is why the Euribor is rising even though there are still no official changes.

In this environment it is normal to wonder what to do with your mortgage, whether you are looking for a house and need to finance the purchase or if you already have one.

What to do if you are looking for a mortgage

Fixed-rate or variable-rate mortgage? That is the key question, the one that every home buyer with a mortgage asks themselves. The possible rise of the Euribor is crucial when it comes to making a decision, at least from a financial point of view.

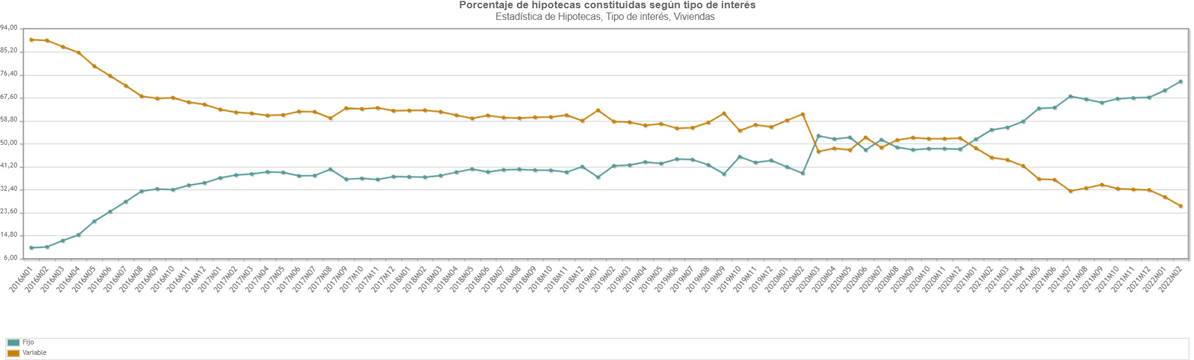

The period of negative and 0% rates that we have experienced has allowed the growth of fixed rate mortgages. Historically, variable-rate mortgages have dominated the market, but in recent years more and more fixed-rate loans have been signed, according to data from the Spanish National Statistics Institute (INE).

This is the result of being able to take out a fixed mortgage at competitive and low rates, something that was not the case in the past.

How does the foreseeable rise in the Euribor affect this decision? The increase in rates and the Euribor will push up the interest rate on fixed mortgages. In fact, some financial institutions have already started to raise it and to promote variable rate mortgages more actively.

Don’t be fooled in this regard either. The Euribor rising will mean paying more for a variable-rate mortgage. Moreover, if the Euribor is going to rise and remain high, a fixed rate at current levels could help you offset this hypothetical increase.

An intermediate solution would be a mixed mortgage. These offer a fixed rate for the first few years and a variable rate thereafter. This way you can protect yourself against the rise of the Euribor while gaining time to plan and see what happens in the future.

In short, from a financial point of view you will start out paying less with a variable rate mortgage, but things could change quickly depending on how much the Euribor rises and the way it does so. If this increase is rapid and substantial, that initial advantage may vanish.

In any case, the decision about which mortgage to take out goes beyond the movement of the Euribor. It is a decision that is related to the level of security you seek for your finances and how you want to plan.

A fixed-rate mortgage is more secure because you know what you are going to pay each month over the life of the loan. This allows you to plan your finances better, without the uncertainty of how much you will pay for your mortgage next year.

On the other hand, variable rate mortgages may be cheaper, but they involve an added risk that you do not control: changes in the Euribor. However, if you are sure from the beginning that you are going to pay off part of your mortgage at some point, you will be able to adjust the timing to benefit even more.

Is it advisable to pay off your mortgage now?

Paying off your mortgage involves repaying either part or all of it in advance. The most common reason for this is because you want to:

- Pay less interest and save money.

- Cancel part of your debts so that you can live more calmly.

In this sense there is something you should understand: whenever you pay off part of your mortgage, you save money because the interest you pay is reduced. The key is to know how much you would save in total and if there are better options for your money. That is where the interest rate on the mortgage comes in and, if it is variable rate, the Euribor, too.

In an environment where interest rates are close to zero percent, it is usually not worth repaying the mortgage because the savings you will achieve in the long term will be very limited.

Let’s look at this with a example. The starting point is a 100,000 euro mortgage to be paid back in ten years at a final rate of 1% after including the Euribor (right now it would be a mortgage at Euribor +1% spread) in which we want to repay 20,000 euros. What would the total savings be? 1,038 euros if you reduce the monthly payment and keep the term and 1,907 euros if you reduce the term of the loan (more on how to choose between the two later).

In both cases this seems like a reasonable amount, but is it the best decision for your money? Could you do something better with it? It’s possible. In theory, the way to make this decision is to compare this saving with what you could get if you decide to invest that money. That is why it is often said that when rates are low, as in the current environment, paying off the mortgage is not worth it.

And when the Euribor rises? Then yes, it may make sense to pay off part of your loan.

However, as is the case when deciding between a fixed or variable rate mortgage, not everything is numbers and not all numbers tell the whole story. On the one hand, not all investments are equally profitable and not all investments are equally safe. On the other hand, your risk profile as an investor is very important.

For you to understand better, paying off your mortgage involves a safe saving, no matter what happens. This being the case, the fairest thing to do would be to compare this operation with equally safe products, such as a deposit. According to data from the Bank of Spain (BdE) the profitability of these is barely 0.02%. In this case, paying off the mortgage would be better.

Unfortunately, that’s not exactly the case either. If you have a long-term outlook you can risk a little more and then more interesting options open up for your money, those that can offer higher returns than the mortgage rate. With this in mind, you can use your mortgage rate as a reference for your decision, although you shouldn’t forget personal factors like the peace of mind of knowing that you have less mortgage to pay or the possibility of not being so strapped for cash at the end of the month if you decrease your payments rather than the term of the loan.

Payments or loan term? which is more profitable

When repaying part of the mortgage you have to choose between two options:

- Reduce your monthly payments while maintaining the length of time you will pay the mortgage for (the term).

- Reduce the term of the mortgage and keep the monthly payment the same. This means you continue to pay the same each month, but over less time.

Which of the two is more profitable? A calculator tells us that it is the second option. Decreasing the term of the mortgage gives a greater saving. However, it may not be the best option.

Once again, there are other factors to consider. The first has to do with flexibility. Reducing your monthly payments allows you to pay less each month and gives you options to decide what to do with that money.

You could invest it and get an additional return. You can even save it and use it to repay part of the mortgage and reduce the term if you want to.

Conversely, if you reduce the term of the mortgage you will never have those options because you are unlikely to be able to extend the term of the loan again.

The second is related to the return that you could receive for the money, something that is never included in this type of calculation. Once you add everything up, it’s easy that in the long run the total return from reducing your monthly payment will outweigh that of reducing your term.

Finally, one more tip if you are thinking of paying off your mortgage: the sooner you do it, the more you will save.