When to start planning

The best time to invest was yesterday, the next best is today. This is a well-known maxim within the financial world that applies perfectly to when you should start planning for your retirement.

In reality, most people do not think about saving for retirement until they are 40 or 50 years old. This very common mistake means that they do not take advantage of one of the greatest allies for the saver and investor: time.

A more gradual effort

The first great advantage of beginning your retirement planning early is that the effort needed is much more gradual.

To make it easier to understand, if you want to save 24,000 euros in 10 years, you will have to contribute 2,400 euros each year or 200 euros per month. To reach the same figure in 5 years, the required savings rate doubles. In other words, you have to make a much greater effort.

Instead of 200 euros a month, you need to save 400 euros.

Now imagine that this figure is not 24,000 euros, but the 150,000 euros you will need to retire (here you can see how to calculate your figure).

This is the monthly savings rate depending on when you start planning your retirement assuming you retire at 67, which will be the legal retirement age from 2025 onwards.

| Age | Monthly savings | Annual savings |

| 25 | 297.6 € | 3,571.4 € |

| 30 | 337.8 € | 4,054.0 € |

| 35 | 390.6 € | 4,687.5 € |

| 40 | 462.9 € | 5,555.5 € |

| 45 | 568.1 € | 6,818.1 € |

| 50 | 735.2 € | 8,823.5 € |

Fortunately, time does not only make the effort gradual. When we add investment and compound interest, its influence is multiplied.

The power of investing for the long term

Time also works in your favor when investing.

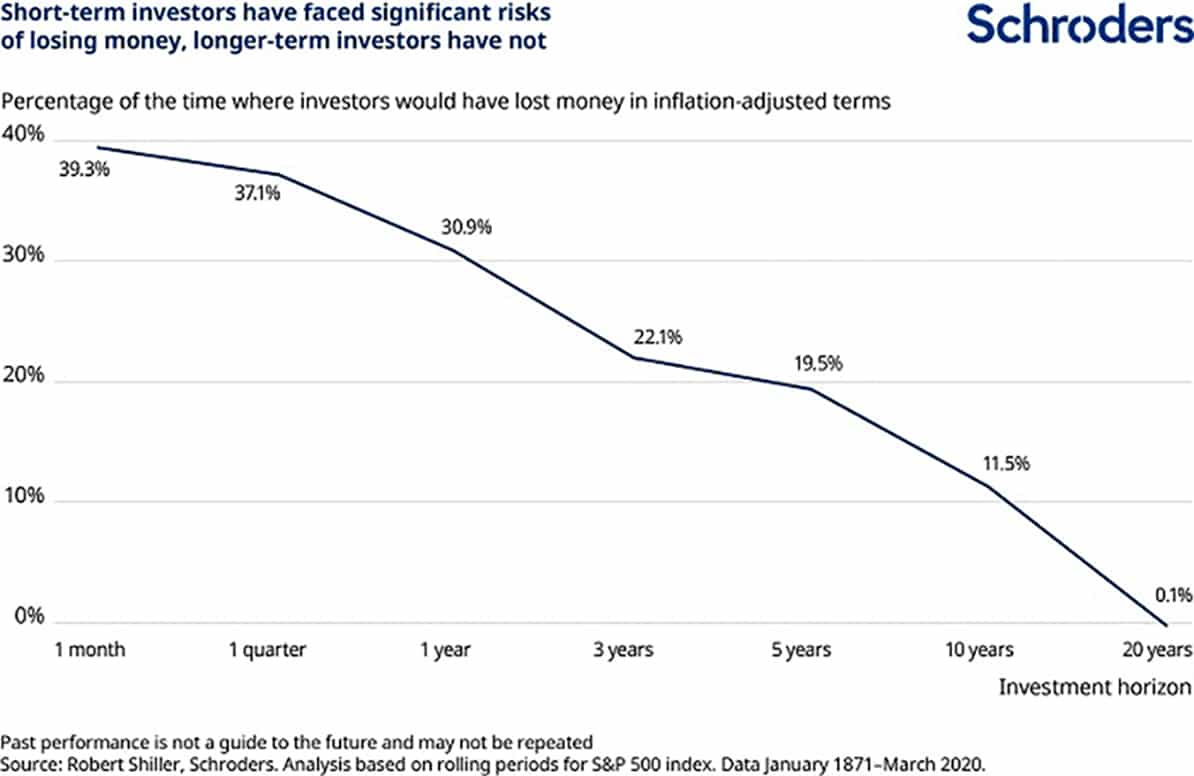

On the one hand, there is a relationship between the time horizon and investment risk. In short, the chances of losing money are reduced when you keep the investment for the long term, as summarized in this chart from the asset management company Schroders.

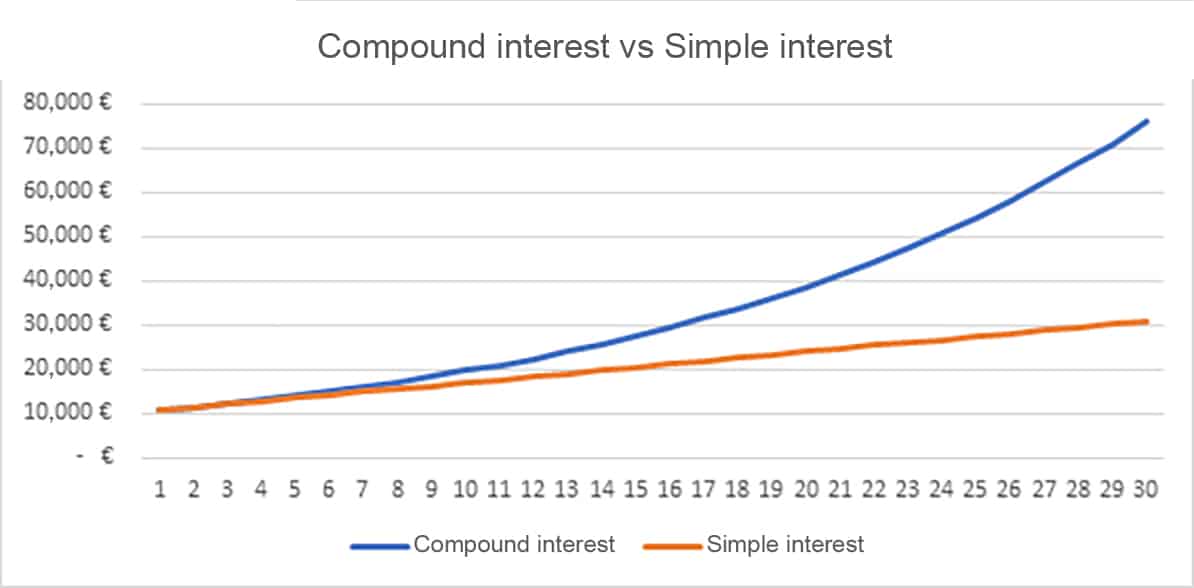

On the other hand, thanks to compound interest, the interest generated by an investment increases over time. This means that your capital grows exponentially.

Here is what happens if you invest 10,000 euros and have a constant return of 7% over 30 years.

What if we add monthly contributions? In that case the effect of compound interest and time is even greater.

Even without any savings as a starting point, reinvesting profits pays off. For example, if you save and invest 200 euros a month at that constant 7% interest, after just 11 years the interest you generate will exceed the amount you save each year.

After 18 years, the interest generated by the investment will exceed everything you have saved. As you can see, time is on your side. That’s why the best time to start planning for retirement is today.

The difference between starting early and starting late

The best example of the difference between investing for retirement early or late is that, if you start early enough, you can generate more money in less time saving than a person who starts saving later.

Include second graph from the article Why you should start investing ASAP.

Again, starting early is rewarding.

You’ll also enjoy those savings today

There are two main reasons to put off saving for retirement. Firstly, it is something in the distant future, and there always seems to be time to address it. As you have seen, it doesn’t have to be that way, at least if you want to enjoy a dream retirement.

The second reason is that it means making an effort today for something you will enjoy in the future. That’s why you hear phrases like “life is for living”, “no one knows what will happen tomorrow”, and “I don’t need to be the richest person in the cemetery”.

However, the reality is that you will also be able to enjoy that effort today. This is because knowing that you are saving and having that financial cushion will give you peace of mind that will make your life better today as well.

For example, if something unexpected comes up, you will have savings to deal with it and, in any case, you will sleep better knowing that you have your financial plan in place.