How the state pension is financed

One of the keys to knowing whether the Spanish pension system is sustainable is to understand where the pension money comes from. In other words, how the State Pension System is financed.

In Spain, at the end of August 2023, there were 10.07 million pensions (and pension-type benefits), of which 6.38 million were retirement pensions, the largest group by far.

In total, spending on retirement pensions amounts to 8,878 million euros, well above the other benefits, too.

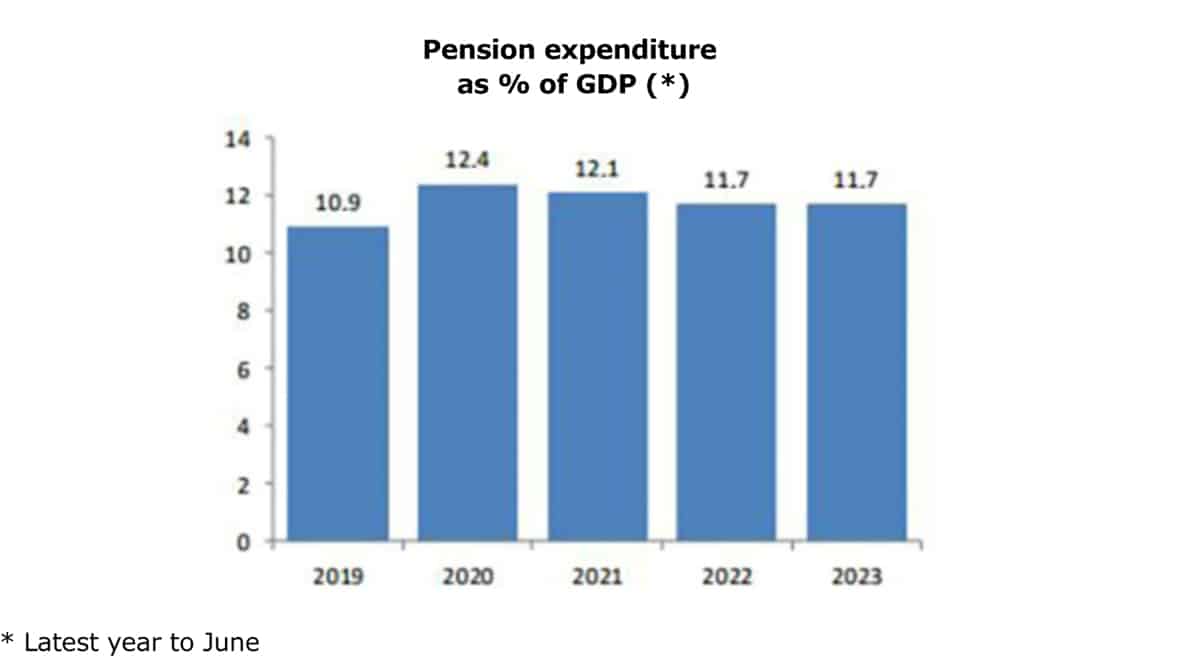

Spending on contributory pensions in the public system is equivalent to 11.7% of the national Gross Domestic Product (GDP), a huge figure and one that will continue to rise as baby boomers retire.

In short, a huge amount of money that has to be paid out each month and which, in addition, goes up because of the way pensions are updated.

Who pays the pensions

How is the money for Social Security pensions obtained? The Spanish pension system operates through the contributions of workers and employers with an intergenerational solidarity model.

In other words, active workers pay for pensioners’ retirement. It is as simple as that. In reality, they use a part of their paychecks to finance retirement pensions and other benefits, such as unemployment benefits.

In fact, every paycheck includes the amounts that the worker contributes into the system, to which must be added the company’s contributions for each worker, which are higher than the employee’s own contributions.

Each employee pays into the system according to their salary and there are a series of maximum contributions. In other words, no matter how high a person’s salary is, there is a maximum amount that will be allocated to pension contributions. That being said, the pension reform of 2023 has established a roadmap so that these maximum contributions will increase by 38% up to 2050.

A solidarity contribution has also been added for the part of the salary that exceeds the maximum base. This will be 1% in 2025 and will increase by 0.25 percentage points each year until it reaches 6% in 2045, although workers will pay in just one percent. The rest will be paid by their employers.

Finally, an intergenerational equity mechanism has also been implemented that represents an overpayment of 0.6%, which will rise to 1.2% in 2029 and be maintained until 2050.

Unemployed people also pay into the system

If you are unemployed, you continue to contribute to the system, although only if you are entitled to a contributory unemployment benefit.

The state or, rather, the SEPE (Servicio Público de Empleo Estatal), pays your social contributions at the same contribution base level that you were paying in your last job.

Who pays when contributions are not enough?

The pension reform seeks to solve the answer to the following question: Who supports retirees when pension contributions are not enough to pay them?

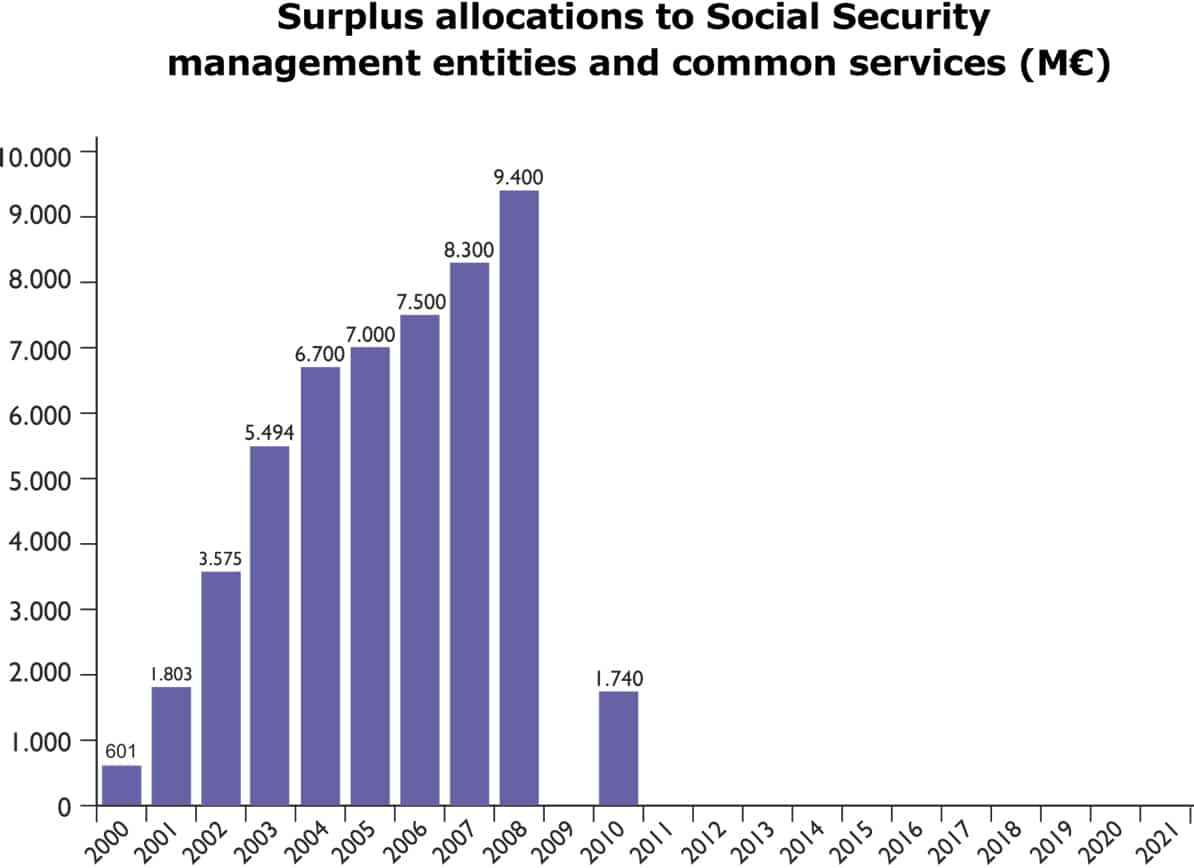

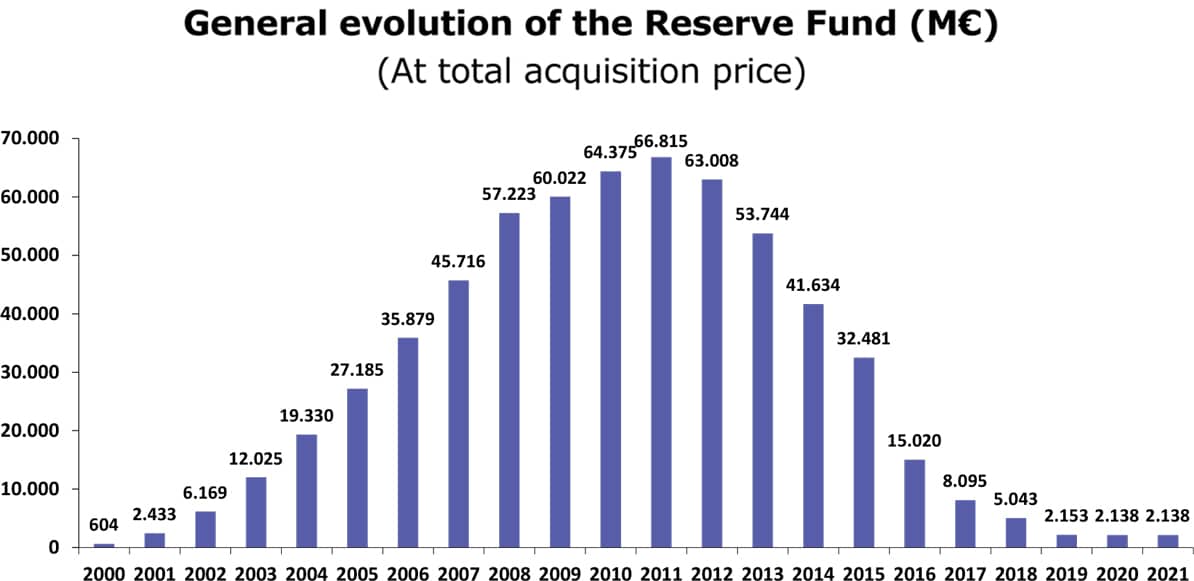

The solution is simple: the Social Security Reserve Fund, which collects the annual surplus between the income and expenses of the pension system. This surplus became a deficit during the financial crisis that began in 2008, and the resources of this Guarantee Fund were practically exhausted.

Since 2011, various drawdowns have been made from the fund to pay for pensions and, as of today, that pension piggy bank is practically empty.

This is due to the Social Security’s constant state of deficit. No surplus allocations have been made since 2010.