That was the initial scenario at the beginning of the pandemic, and it is the same now, with even more uncertainty due to the geopolitical situation. What should you do with your money in a market crash? How to invest in times of crisis?

If you already invest and have a plan The answer is simpler than you think: keep doing the same thing. It’s as simple as that.

The most common mistake when there are stock market falls is to panic and sell . It may seem reasonable to pull out of the market during a crisis, but it’s not the best solution, especially if you are investing for the long term, as most of us are.

Want to know why? Let’s have look.

It’s time, not timing that counts

In the short term there may be falls (and there will be), but the general trend of the markets is upwards. In the long term, the stock market rises, this is what the numbers and statistics say.

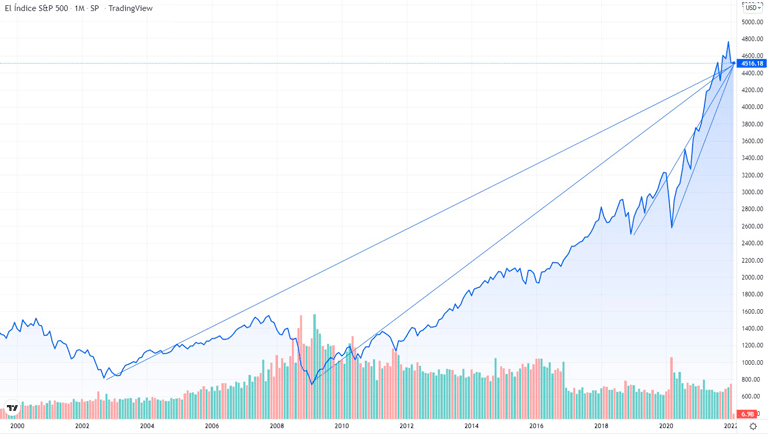

The following graph illustrates the performance of the S&P 500 (representative index of the American stock market).

As you can see, there were important falls in 2000 with the dotcom crisis, the subprime mortgage crisis in 2008, and even coronavirus in 2020. Nevertheless, the stock market was able to recover from all of these and continue to grow.

So much so that no-one who had invested money in the S&P 500 for the 20-year period between 1900 and 1919 would have lost money, according to a JP Morgan Asset Management study. The reason is that the time you stay in the market is actually more important than knowing when to buy and sell.

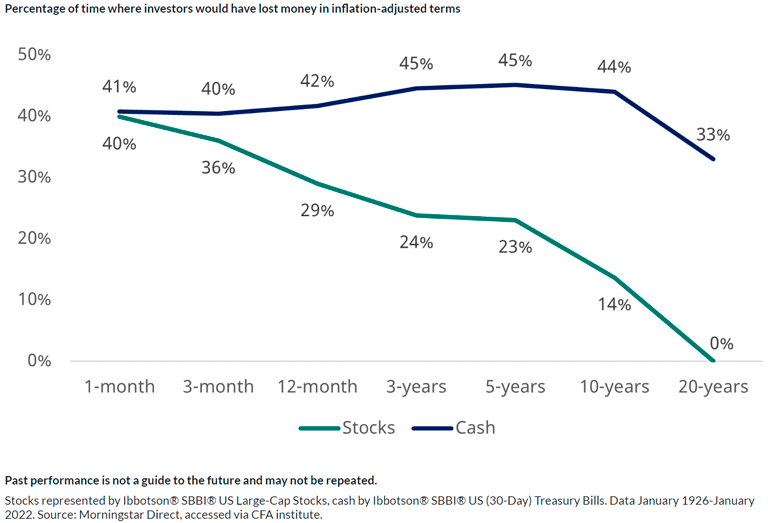

In fact, time is your greatest ally as a private investor. The following chart from fund manager Schroders illustrates this perfectly. The longer you hold the investment, the less chance there is of losing money.

That is why, if you invest for the long term and have a plan, you should stick to it. Your pocket will thank you.

It’s easy to sell at the worst time and miss out on the best

When you panic sell, you usually do so after a big drop. The average investor, who does not pay attention to the day-to-day trading in the markets, tends to unload their holdings after a warning from their broker, advisor or when they see a news item in the media or on social networks.

What is the problem? well, by then it is likely that a large part of the fall has already occurred, especially on the day of the stock market’s greatest drop. In other words, you will be selling close to the lowest point.

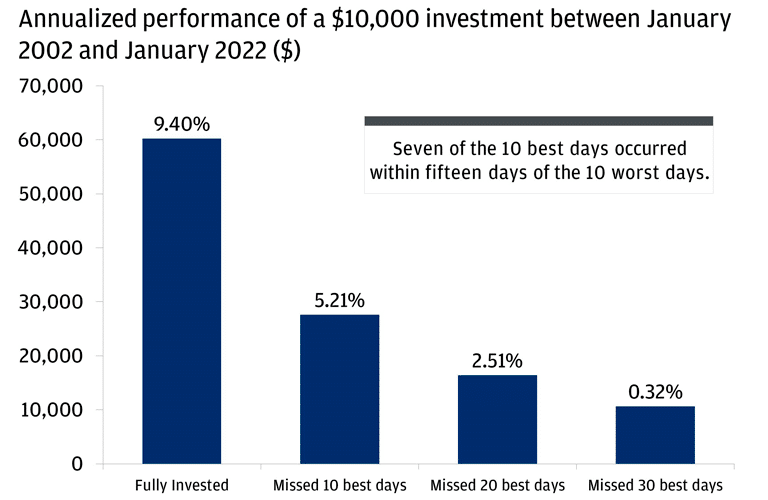

To this is added an additional handicap: the stock market’s biggest rallies tend to occur within 15 days of the biggest drop . This has been the case over the past 20 years, according to another J.P. Morgan study.

And missing out on just the 10 best days, the ones when the stock market rises the most, has a huge impact on your long-term returns.

If you sell after a downturn, it’s easy to be underinvested when the upturn comes. What’s more, some people won’t even invest again, and then inflation will eat up their savings.

Can you take advantage of downturns to invest better?

Sticking to your long-term investment plan is the least you can do. But is it possible to go further?

An oft-repeated piece of advice is to take advantage of these downturns to invest even more. That’s what, for example, the bestseller “Asymmetric Financial Warfare” proposes, which even advocates automating those additional inputs.

The logic of investing more during or after downturns is simple. You have just seen how the long-term trend of the stock market is positive. As a long-term investor, what you do in a crisis or downturn is to buy something cheaply that you know will rise in price over the long term.

For that additional investment you have the liquid assets in your portfolio, which you should not confuse with your emergency cushion. That liquid cash is money that you can keep in safe products waiting for investment opportunities to arise.

What if you still aren’t investing?

In that case the crisis should not make you pull back. The best time to invest is now and it will still be in a day, a year, and a month because when it comes to investing, time is more important than timing and as we already explained, saving is not enough to achieve your goals.