It’s like a vicious circle that prevents you from moving forward. The reason for this is very simple: they are processes that depend on your willpower. Even when you build the right habits, it’s easy to have slip-ups that undermine your confidence and make you feel guilty.

That’s what happens when you cheat on your diet because you go out for a drink or indulge in a treat, you can’t find time to go to the gym this week, or the month when you spend too much. Sometimes these are one-off hiccups, but other times they can be the beginning of the end.

The reason? The system you use depends on your willpower and this is limited, as various studies have shown. It is a phenomenon that also occurs in other areas such as concentration or decision-making (this is known as decision fatigue). In the end, our bodies and minds have their limits.

You know what doesn’t have those limits? Systems that work automatically and that you can make work for you.

These are systems that operate on autopilot, which only need a few small commands to set them in motion and, once they are up and running, continue until you give a stop command. It is somewhat similar to the effect habits have on human beings, only much more powerful because habits still depend on your willpower to a greater or lesser extent.

What does automating your finances consist of?

Automating your finances means putting saving and investing on autopilot. In other words, creating a system for your money that works each month while you do nothing, or almost nothing.

For example, saving without having to make a savings transfer every month, investing without constantly having to think about how and where to do it. And how does this work? By programming in advance what you want to do with your money. It’s as simple as that.

The advantages of automating your savings and investments include:

- Having the peace of mind that your finances are on track, no matter what. It doesn’t matter if you’re swamped with work or you’ve just become a parent and don’t have time. With an automatic system, everything keeps flowing, avoiding excuses or forgetfulness.

- Acquire a level of discipline and constancy of habits. In reality, the system will do everything for you, but mentally you will get used to knowing that you are saving every month and you will get into the habit of doing so.

- Focus on the long term when it comes to investing. An investment system that works automatically invests each month, no matter what. This stops you from falling into the market timing traps we talked about in the article on whether it’s better to invest all at once or little by little.

And the downside? The truth is that there are no clear disadvantages to automating your finances, except that there will be months when it will be better for you to do so and others when it will be worse.

From the investment standpoint, the handicap is that there are certain investment formulas, such as purchasing shares on the stock market, for which this model cannot be 100% automated.

How to automate your finances

Setting up an automatic system for your money is easier than you think. Your main tool will be periodic standing orders for both the savings and investment parts.

In the end, the idea is to implement the system we explained in the article on the secret to saving effortlessly. In short, pay yourself first and pre-save, something you can do in two steps:

- Choose the percentage of your income that you want to pre-save each month.

- Order a periodic transfer from the account where you receive your salary to a savings account at the beginning of the month. Ideally, you should do this so that the money comes out of the account as soon as you receive it.

In five minutes you will already have started saving a percentage of your income for life. All you have to do is adjust that figure if you get a salary raise, when you receive a bonus, or if you want to save more money.

You should use the same system to automate your investments. This means directly, periodically and automatically sending the contributions you are going to make to the investment products you choose according to your objectives or your risk profile.

For certain products you will need a financial middleman or broker, so you will first have to send the money to the broker via a standing order from your bank, and then create the standing investment order with the broker. In other words, include an additional step in the system that you have already seen.

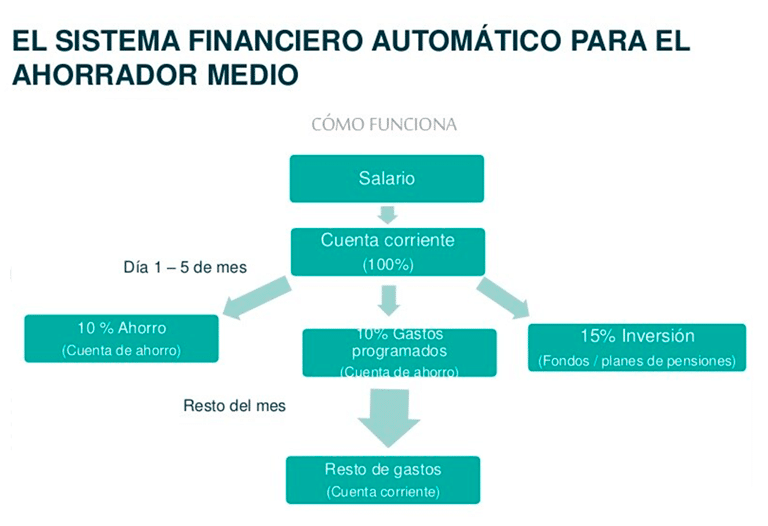

Once you are done, the system will be similar to that shown below.

In fact, this is an adaptation of the system used by Ramit Sethi in his book “I Will Teach You to be Rich” and summarized by financial expert José Trecet in the following video for Value School.

What other habits can you automate?

Automation is a powerful weapon that you can implement in other areas of your life to a greater or lesser extent.

For example, you can create automatic decision-making systems or work systems using tools like Workflow, Trello or Notion.

These allow you to create a system that automates certain tasks or, at least, shows you the steps you must follow when making decisions.

For example, before making a purchase you can create an automatic system that helps you decide whether or not you should buy that thing. This involves implementing a series of steps that you must take before finalizing the purchase decision, such as asking yourself if you have a similar item, if it is a necessity or a whim, or if you can find it cheaper somewhere else.

If you get through all the filters, you can buy it.

In terms of grocery shopping, it is possible to automate all your purchases with pre-designed weekly shopping lists via an online supermarket so that you only have to buy what you need each week. This lets you save on groceries and ensures that you eat what you want. In other words, you can eat a more balanced diet (if you want to).