All at once or little by little? What is the best way to invest?

When it comes to starting to invest there is one question that is asked time and time again. Is it better to invest all at once or a little at a time? The two reasons for asking this question are that investing can be scary and that most people wait until they have some money saved before taking the plunge.

The issue is not trivial and, like everything that has to do with personal finances, there is an exclusively financial part and a much more personal part that you must also take into account. The purely numerical part is always the easiest to work out, so we’ll start there.

All at once or little by little, which is more profitable?

Vanguard, the pioneer in index funds and passive investing, asked this question at one point. The answer came in the form of a study, the title of which already provides a solution to the dilemma: “Dollar-cost averaging just means taking risk later”, which could be translated as “investing little by little just means delaying risk”.

The research compared the results of these two investment strategies between 1926 and 2011 in the U.S., U.K. and Australian markets. The results could not be clearer: in 66% of cases, investing all at once offered better returns than doing it little by little.

Historical probability that investing all at once is more profitable than doing it little by little

| USA | United Kingdom | Australia | ||||

| All at once | Little by little | All at once | Little by little | All at once | Little by little | |

| 100% variable rate | 66% | 34% | 68% | 32% | 62% | 38% |

| 60% VR / 40 FR | 67% | 33% | 67% | 33% | 66% | 34% |

| 100% fixed rate | 65% | 35% | 61% | 39% | 58% | 42% |

The conclusions of the study leave little room for doubt: investing all at once, with what Americans call a Lump sum, is more profitable than doing it little by little through a Dollar Cost Averaging (DCA) strategy, which basically consists of investing the same sum in small amounts over a period of time.

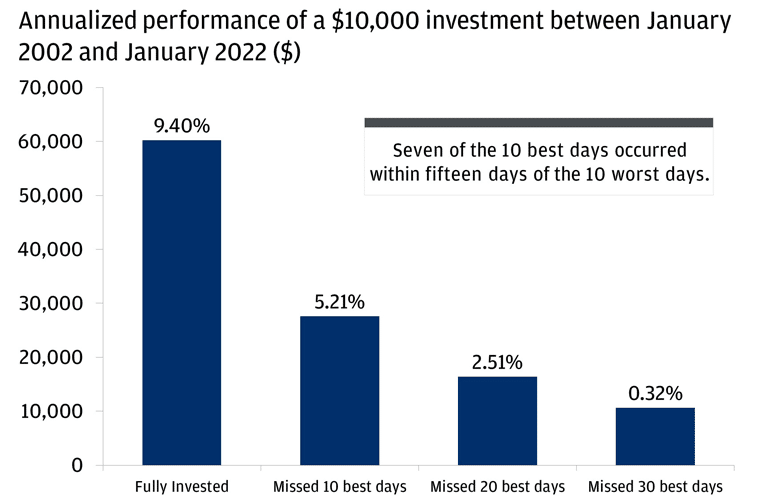

Why is it better to invest a lump sum? There is a very clear answer: the more time you spend in the market, the more likely it is that your profits will increase. That’s how simple and stubborn investment statistics are. In fact, according to a study conducted by J.P. Morgan, if you just miss the 10 best days of the year, your profit will be reduced by almost half.

As we explained in this article on investing in times of crisis, for most people it’s the time you spend in the market that counts, not market timing (or buying and selling at the right time).

This is what the numbers say: clear, cold and unyielding. The problem is that when it comes to finance, numbers are not the only thing to consider. In other words, investing all at once may not be the best strategy for you or for most savers. The reason is the fear that we mentioned at the beginning.

The alternative of investing little by little

As opposed to investing all at once, there is the possibility of investing periodically, through the DCA strategy. In a nutshell, this formula divides the initial money into small amounts to be invested over time.

In the Vanguard study, the initial investment was spread over a 12-month period. For example, if you have 6,000 euros, you would invest 500 per month over the year, or 1,000 per month for six months, depending on your preference.

The key question is, why invest little by little if it is not the most profitable way? Because it has a number of other psychological advantages that make it a better option for the investor, especially the novice.

By investing in small amounts you are diversifying the initial risk of suffering losses (or delaying it, according to the Vanguard report). To make this easier to understand, imagine you take the money you have saved, invest it all, and the market turns around and you have suddenly lost 10% of your investment. How would you feel?

Probably awful and maybe even very guilty. Indeed, for many this can be a sign that they should withdraw their money and never return to the market, especially if they have invested more money than they should have (here you can see how much to invest according to your situation).

Investing little by little eliminates that problem and makes possible market downturns more bearable, and you can be sure that there will be some. If you invest 10% of your money and the market drops after two days, it will be a small bump, not a huge pit.

From a financial point of view, with the DCA system you assume that there are times when you will buy high (the stock market goes up) and times when you will buy low (the stock market goes down). In the end, you will have bought at the average price for that period of time (hence the “average” in the name).

The DCA system can be applied both when you have saved an amount of money and want to invest, as well as for the part of your budget that you want to allocate to investment every month. You can either wait to collect some money and invest it or you can invest that amount every month on a regular basis and, best of all, automatically.

In fact, you can start doing this right from the beginning. Today you do not need a large amount of money to start investing. These days there are alternatives to help you make the leap from saver to investor where you only need to have the capacity to contribute some money each month, with no initial capital to start with.