That is why it is essential to save at a rate that is in line with your financial goals.

What is a savings rate?

Your savings rate goes far beyond the money you put away each month or how much you save. It is a statistic that relates your savings to your income and, therefore, gives you a more accurate picture of your savings effort.

It can be defined as the percentage of your salary that you save each month. It’s that simple.

It is a very easy piece of information to find out, but it can give you a lot of information and it is more important than most people think.

Why is it so important?

Your saving rate is a critical piece of data for two reasons.

The first is that it helps to put your savings in context. Saving 250 euros a month may seem a reasonable amount, but its dimension changes completely if we are talking about 10% of your salary or 20%, for example.

The first case is a savings rate that would be more or less suitable in the best case, while the second case is an ideal scenario.

The second reason why your savings rate is even more important than the return you can get for your money is that the greater that percentage, the easier it will be to achieve financial freedom.

Because your financial freedom depends as much on how much you earn as it does on how much you need to live. The less you need, the easier it is to build.

The following example will help you understand this idea better. If you save 20% of your salary, every four months you will have one month of financial freedom. In other words, for every four months of work, you will be earning one month’s salary where your lifestyle has already been covered by your savings effort.

That’s why it’s key to have a good savings rate, one that really helps you reach your goals.

What does investment provide?

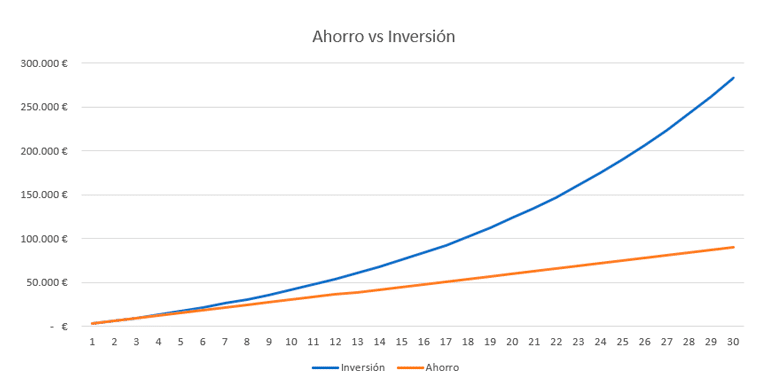

And investment? As Luis Pita explains in “Libre”, his latest book, investing is an accelerator towards financial freedom. It is like adding two or three gears to your car and it is also important.

On the one hand, is the best way to protect your wealth against inflation. By investing, you prevent your savings from losing value due to the rising cost of living over time.

On the other hand, it is an added boost to help you achieve your goals. Investing is the most accessible passive income model for most people. Thanks to compound interest, your money will grow exponentially over the long term.

The way to increase your income

Having a good savings rate is life insurance against any unforeseen event that may arise. For example, if you are left with no income and you have been saving 20% of your salary for a year, you will have two and a half months of financial cushion to cope with the situation.

However, it is also true that, if your salary is limited, achieving financial freedom with a fulfilling lifestyle can be complicated. You may get some degree of financial freedom, but with a standard of living that may not be what you were dreaming of.

In these cases, in addition to saving and investing, you can also increase your income. Basically you can do this in two different ways.

The first and simplest is to increase your salary, either by asking for a raise or by moving company, for example.

The second is to look for other sources of additional income such as combining a job with freelance work, starting a side business or earning the famous passive income, which is never as passive as you think.

In any case, the idea is to earn more money that will help you enhance your savings rate and/or improve your quality of life if you need it. Of course, never lose sight of the maxim that the more you need to live, the more difficult it will be to achieve financial freedom.