How to supplement your state pension

…Many people wonder what their future will be like after they retire. On the one hand, retirement is a time for you to enjoy after years of work. On the other hand, it is normal to have doubts about what this new life will be like and the financial resources needed to live it to the fullest.

This is where doubts arise, such as whether a pension from the government will be sufficient or whether it is necessary to supplement the state pension with some additional income. The problem is that many Spaniards face this uncertainty without really knowing what to do and letting time pass without planning.

These are the steps to take to avoid this mistake.

Will it be necessary to top up your state pension?

Thinking that your state pension will be enough is one of the five most common mistakes when planning for retirement. And this is not a shortcoming related to the amount of the benefit, but rather to not knowing the true numbers of your retirement.

In other words, not knowing how much money you will need to retire. It is very typical to dream of a retirement full of travel and fun, but without having even a rough idea of how much it might cost from a financial point of view or whether the state pension will allow you to afford it.

For this reason, the first thing to do is to figure out how much the retirement you want will cost, and how much you can expect to receive from your state pension. Remember, however, that the way the pension is calculated and the amount itself may change over time.

This information will help you to know whether you need to supplement your state pension and by how much. For example:

Now you earn 2,500 euros a month.

When you retire, at the very least, you want to maintain your standard of living, although you would also like to travel. You do some calculations and estimate that you will need 3,000 euros a month or 36,000 euros per year.

You estimate that the state retirement pension will be around 1,750 euros.

Results: you need an additional 1,250 euros per month to top up your state pension.

Now we have to see how to get that amount.

Plan: save and invest

How to top up your state retirement pension? The simplest and also the most traditional way is with savings and investment.

In other words, spend less than you earn and invest part of that money. The best method for saving effortlessly is to set aside a percentage of your income at the beginning of the month and do this automatically through pre-savings. This way you will be saving every month of your life at a stroke.

In addition to saving, it is also necessary to invest that money for two reasons.

The first has its own name: inflation. Inflation is the increase in prices over time and it marks the increase in the cost of living. Its effect on your savings is very simple: they will lose value over time.

To make this easier to understand, if you used to need one euro to pay for a coffee and now you need 1.2 euros, your money has progressively less value. The nominal value of that euro is the same, but its real value is less because you can no longer get a coffee with it. In other words, you need more money to do the same thing or maintain your standard of living.

The way for your savings to maintain their real value and not just their nominal value is to invest them to obtain a return that is at least equal to inflation, although ideally it should be higher.

The second reason to invest is that investing is an accelerator for achieving your goals. Thanks to compound interest and the return you get on your capital, your money will grow faster and, therefore, you will have to make less effort to collect the amount you need to retire.

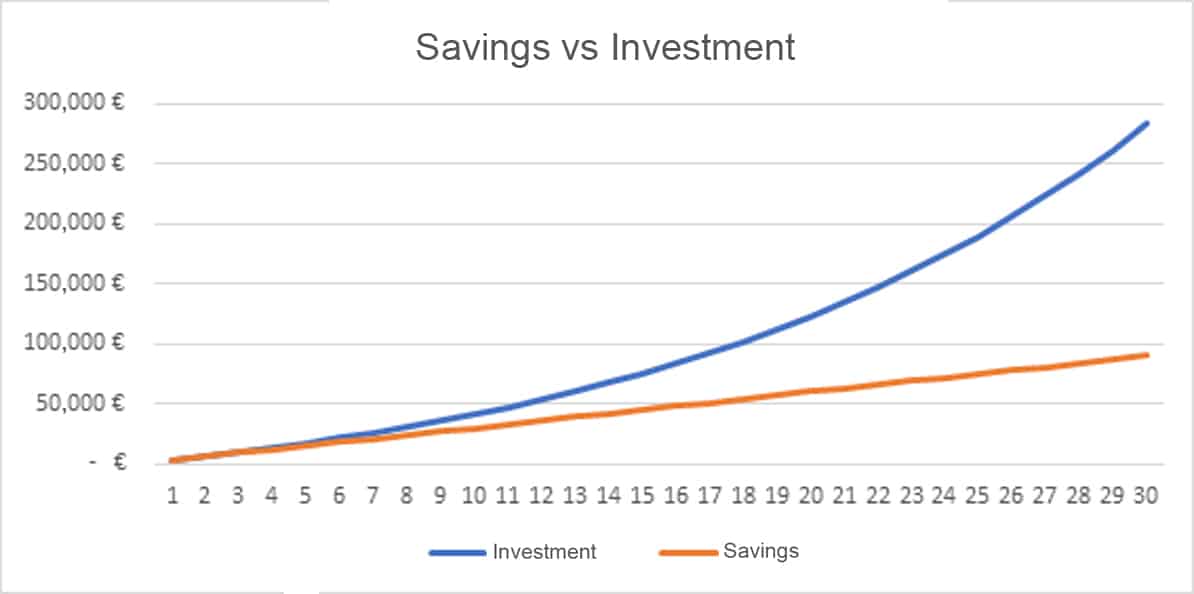

Here you can see the difference between saving 250 euros a month and investing that same money at a constant interest of 7%:

Through your savings you will have added 90,000 euros after 30 years. If you also invest, you will end up with 283,282 euros, more than triple.

The key at this point is to start investing as soon as possible and do it with the right investment products.

Generate additional income (passive or not)

Along with investing, you can also supplement your state pension with other sources of income.

There are two ways to make money when you retire. The first is to keep working and collect the type of pension that makes it possible to combine work with your state pension. The three options offered by Social Security are:

Flexible retirement, whereby the working day can be reduced by between 25% and 50% so that your pension and salary can be received in a complementary manner.

Partial retirement, similar to the previous idea.

Active retirement, whereby you receive 50% of your pension (100% if you are self-employed and have employees), but you can do any type of work or working hours.

In addition, it is also possible to run a business and collect your pension if you are actively retired. In fact, this format is closely related to the second option for earning money in retirement beyond your pension: passive income.

In theory, this type of income is not directly linked to the time you spend working. A classic example would be renting out a home, which generates money without you having to work for it.

However, you should not let yourself be tricked by this concept. All passive income involves an initial investment of time and/or money and then some management. From that point on, the various possibilities require more or less work to manage.

Other examples of passive income would be creating a YouTube channel or a blog, dropshipping or writing a book. This article shows you more ways to generate passive income.

Take advantage of what you already have: your house

Another way to supplement your state retirement pension is to use the assets that you have acquired throughout your life.

Probably your greatest asset is your home, which you can use to earn money by renting, selling the bare ownership, or taking out a reverse mortgage, to name a few examples.

In the end, it’s all about seeing your home as an asset that you can leverage financially to enhance your retirement.